Separating Fact from Myth in Car Insurance

The CEO of Najm Insurance Services, Dr. Muhammad Al-Sulaiman, estimated that 50 percent of drivers still put off buying car insurance. In many people’s minds having car insurance may not seem important, but accidents happen unexpectedly. With so many stories surrounding car insurance in Saudi, it’s important to know what’s a fact and what’s fiction. So, let’s take a closer look at 7 common misconceptions about car insurance in Saudi to find out the reality.

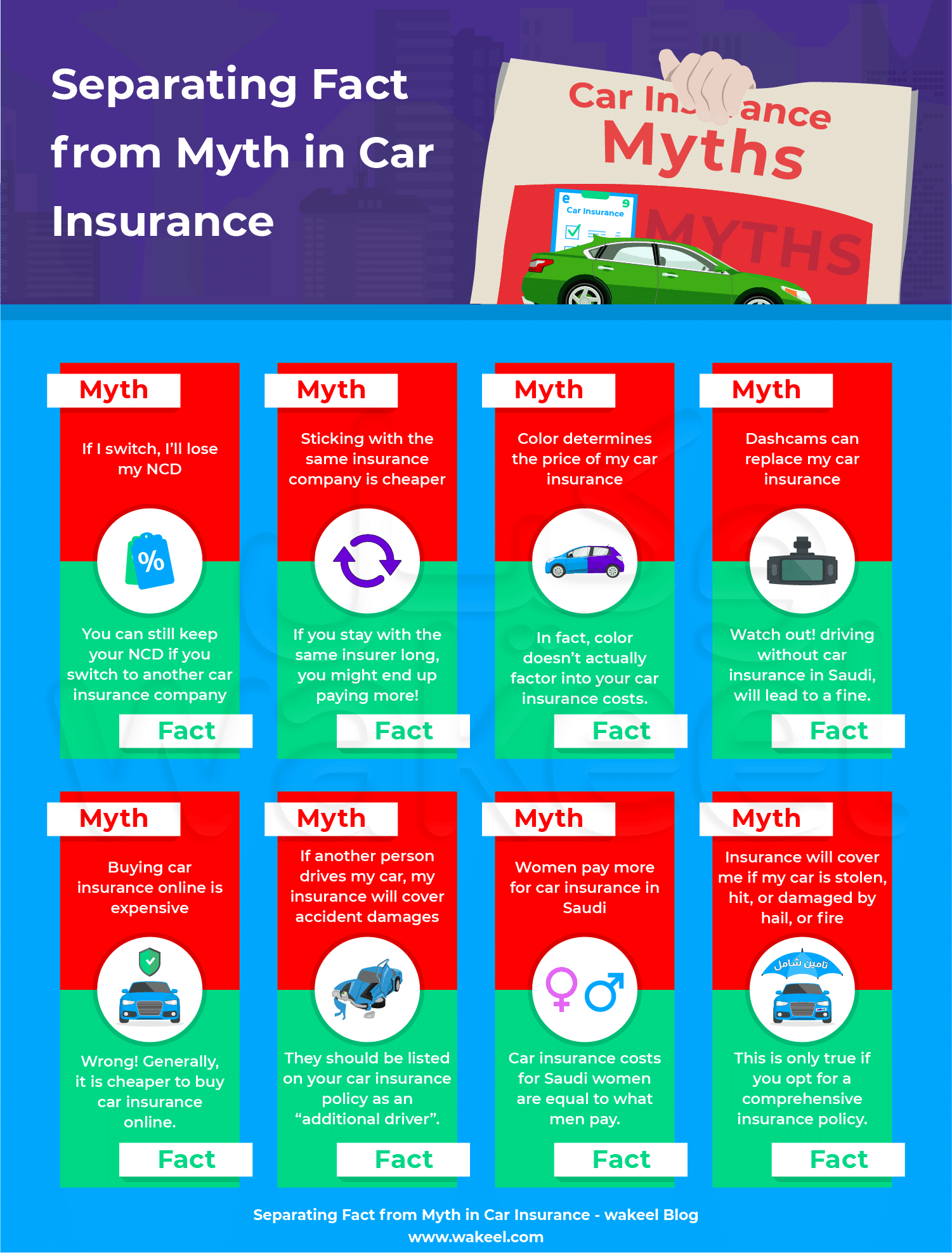

8 car insurance myths debunked

Myth 1 – Dashcams can replace my car insurance

Even if you have a dashcam installed in your car, driving without car insurance generally isn’t an option. Like many countries, having a basic level of coverage is compulsory in Saudi. So, watch out! driving without car insurance in Saudi, will lead to a fine. What is worse, if you do get into an accident without insurance, you’ll be responsible for the damage you caused, including any repair expenses and medical bills.

Myth 2 – Color determines the price of my car insurance

You might have heard that red cars cost more to insure—but, in fact, color doesn’t actually factor into your car insurance costs. Often, insurance companies determine the price of your car insurance based on car make and model, as well as its cost, its overall safety record, and the likelihood of theft. Besides, insurers take into account other factors that affect the price of your car insurance in Saudi

Myth 3 – Sticking with the same insurance company is cheaper

Surely, being a loyal customer equals a loyalty discount. However, if you stay with the same insurer long, you might end up paying more! In most cases, policyholders miss out on great car insurance offers merely because they skipped price comparisons. Therefore, it’s always better to shop around and compare policies to see if you can get a better price elsewhere. PS – you can instantly compare car insurance prices online in Saudi.

Myth 4 – If I switch, I’ll lose my NCD

Many hinder switching their car insurance fearing that they will lose their no-claims discount. Worry not! you can still keep your NCD if you switch to another car insurance company. All it takes to get 10-50% off the price of your new insurance policy, is proof from Najm.

Myth 5 – Insurance will cover me if my car is stolen, hit, or damaged by hail, or fire

This is only true if you opt for a comprehensive insurance policy. Essentially, comprehensive cover and add-ons help repair your car if it’s stolen or damaged in an incident, natural disaster, or fire. For this reason, we recommend Understanding Saudi Compulsory TPL Car Insurance Limits and comparing comprehensive vs TPL before making a decision.

Always read the fine print in your insurance policy! Oftentimes, people buy insurance without getting into details only to find out later that they didn’t get everything that they thought they were getting. This can be the case when you buy a TPL with additional coverage. To find out the difference between the two, read comprehensive insurance rules and compare insurance coverage for each policy.

Myth 6 – Women pay more for car insurance in Saudi

Contrary to common belief, car insurance costs for Saudi women are equal to what men pay to insure their cars. Adel Al-Eissa, spokesman of insurance companies at SAMA, assured that gender is not considered when calculating the price of car insurance: “We’ll deal with women like men with regard to traffic accidents and all technical aspects related to car insurance.”

Myth 7 – If another person drives my car, in the event of an accident, my insurance will cover the damages

If you let someone else drive your car and they cause an accident, your insurance company will accept to pay for the damage under two conditions:

- Said driver must have a valid driving licensee.

- Also, they should be listed on your car insurance policy as an “additional driver”

Myth 8 – Buying car insurance online is expensive

Wrong! Generally, it is cheaper to buy car insurance online. When you purchase an insurance policy online, you can compare several options, pay and complete all the paperwork online. Just make sure to use a Saudi insurance comparison website recognized by SAMA.

All in all, uncovering the truth should help clear your doubts. However, if you’re still looking for a way to save on your car insurance, it could be a good idea to start comparing car insurance rates online!