How the new comprehensive insurance rules impact you

Recently, the Kingdom’s central bank and insurance market regulator, SAMA, has introduced new comprehensive car insurance rules. Basically, these rules aim to define the scope of comprehensive coverage and standardized all comprehensive policies; so as to reduce any disputes between insurance companies and policyholders. In fact, this step comes as part of SAMA’s support to protect policyholders’ rights, and ensure fairness in insurance transactions.

As a policyholder, you need to read and understand how these new rules really impact drivers.

What is comprehensive insurance & what does it cover?

Unlike third-party insurance, buying comprehensive car insurance is optional in Saudi. In insurance terms, Comprehensive refers to the type of policy that covers damage to your car in certain situations and the damage your car cause to other car or people.

According to the rules, all comprehensive insurance policies must cover the following:

- Collisions.

- Fire and theft.

- Damage resulting from natural disasters such as lightning, floods, and hail.

- Towing and storage expenses.

- Alternative rental car coverage.

- Roadside assistance.

- Third-party liability coverage.

What is the purpose of these new comprehensive insurance rules?

Mainly, the new Rules intend to reform comprehensive insurance coverage and establish a regulatory framework. In simple words, these rules help to unify all comprehensive insurance policies in Saudi Arabia by obligating all insurers to provide a “minimum” level of coverage.

Previously, there was no ‘standard’ form for comprehensive insurance; as a result, each company had its own criteria for a comprehensive insurance policy. Consequently, many disputes would arise between insurers and policyholders regarding terms, conditions, and exceptions.

To know more about the provisions of the Comprehensive Insurance Rules, please check SAMA’s website. Find below a summary of key requirements for comprehensive insurance policies.

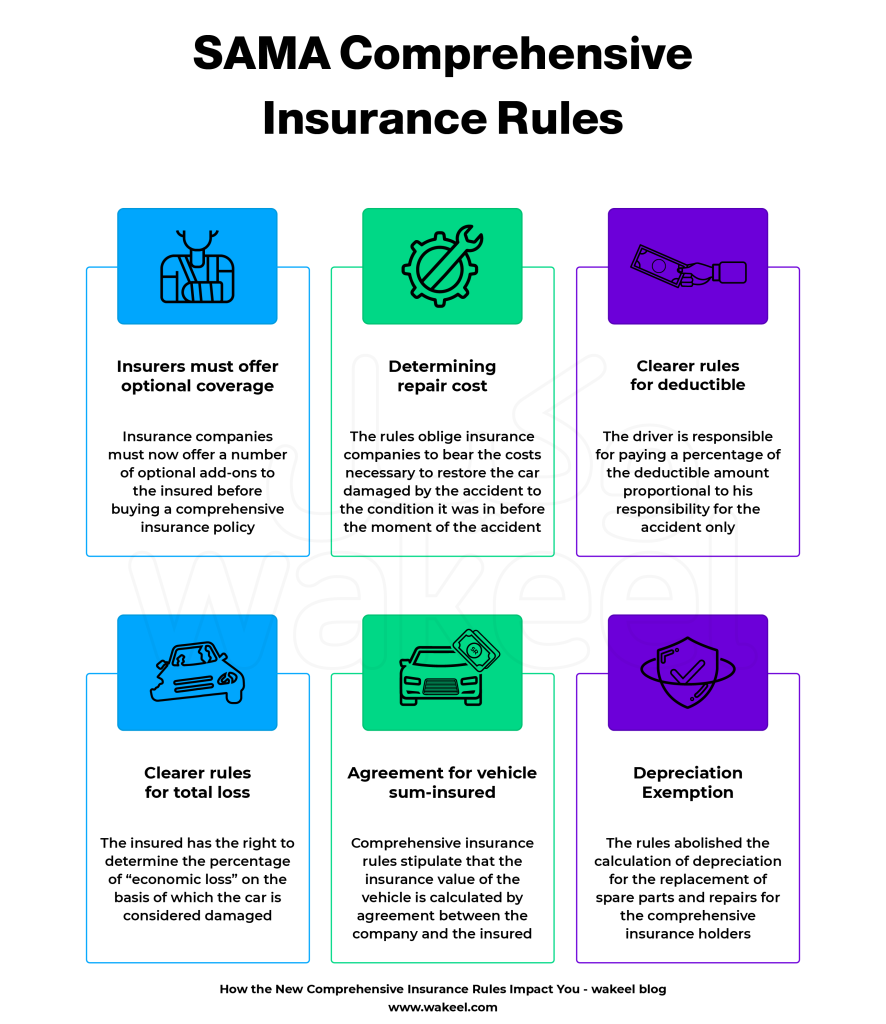

Comprehensive Insurance Key Reforms

Offering optional coverage

Insurance companies must now offer a number of optional coverages to policyholders before issuing the policy. Optional coverage, or add-ons, offers an ‘extra’ coverage policy that comes at an extra cost. Mainly, these add-ons offer the following:

- Additional driver coverage ie. the policyholder’s parents, spouse, sons, daughters, siblings, or a domestic worker.

- Death or bodily injury coverage.

- Medical expenses coverage.

- Covering accidents that occur outside the geographical borders of Saudi Arabia – Read all about geographical coverage extension.

Determining the repair cost

As for claims settlement, the new rules oblige insurers to cover the necessary costs to properly restore damaged cars to their pre-accident condition. When you file an insurance claim, the insurance company must refer you to an accredited vehicle damage assessment center, which will determine the repair cost.

In detail, the repair cost should cover the following:

- The value of repairing the damaged parts as specified in the accident damage assessment report.

- Labor wages in the agency or repair shop (as specified in the insurance policy.)

- Car towing and storage expenses (up to a maximum of 500 riyals inside the city and 1000 riyals outside the city for each claim.)

The provision of applying the deductible amount

Before all else, the deductible amount in comprehensive insurance refers to a fixed pre-decided amount. This amount is what you pay “out of pocket” on a claim before your comprehensive insurance covers the rest. Typically, deductible only applies to at-fault claims, not to claims arising from third-party liability coverage.

Now, here’s how a deductible work in comprehensive insurance according to the new rules.

- Insurers cannot ‘deduct’ any money on third-party civil liability

claims. - A deductible amount is not applicable if you file a not-at-fault claim.

- If you were partially at fault, your insurer will deduct the amount in proportion to the percentage of your liability.

- Moreover, insurers may subtract your deductible if you were responsible for a single-vehicle accident.

- However, the deductible amount may not be doubled under any circumstances.

Depreciation exemption

From now on, insurance companies are not allowed to deduct deprecation from claims payout for comprehensive policyholders. Depreciation refers to the value your car loses over time; due to consumption and regular wear and tear. Find out the percentage of depreciation in car insurance policies.

Previously, insurers would deduct this percentage as per the age of the car. The older the car, the greater the depreciation; Thus, policyholders would often receive compensation lower than the market value of their cars.

Now, the comprehensive insurance rules have made it clear that insurers may not deduct depreciation from partial or total loss claims.

Deciding a car’s value requires mutual agreement

Before buying comprehensive insurance, both the insurer and policyholder must determine how much the car is worth and specify its value in the insurance form. In order to estimate a car’s value, many insurance companies rely on third-party appraisers, known locally as, Showrooms Sheikh. Usually, the car’s value is the amount of money you would pay to replace it with a new car of an identical or equal make and model.

Determining how much your car is worth, or Sum Insured is crucial; because it determines two important things. One, is the price of your insurance policy. Second, if the insurance company declares your car a total loss, the compensation that you are liable to receive will be equal to the car’s value.

Set Economical Total Loss Threshold

This is a big one! Insurance companies consider a car a “Total Loss” in two cases, as follows:

- Technical – when the car is damaged beyond repair ie. not in a roadworthy condition.

- Economical – when the cost of spare parts and labor makes it uneconomical to repair the car.

Of course, when a car is irreparably damaged it’s often obvious that there’s nothing to argue about. However, when an insurance company writes off a car because its repair is unfeasible economically, many disputes can erupt!

Under the new rules, policyholders would be able to specify a percentage at which an insurer can declare a car an economical total loss.

Comprehensive insurance rules impact drivers

These new rules shall offer more clarity, greater benefits, and mandatory coverage. Many customers did not fully understand the difference between comprehensive insurance policies and other products with lower coverage; or, as a matter of fact, the coverage provided in each.

Remember, it’s important that you know your insurance limits and understand how its works. If you understand what comprehensive insurance should cover and compare policies online, you’ll be able to ensure that the insurance product that you buy will cover you when you need it most.