Why Driving a Car without Insurance is Wrong!

Don’t take driving without insurance in Saudi Arabia lightly. It’s mandatory, and for good reason: even a fender-bender can cost a fortune now, with car repairs getting more expensive all the time. And if you get caught driving without insurance, you’ll be hit with fines from traffic cameras everywhere. Since Moroor (The Saudi traffic department) launched e-monitoring for car insurance violations, they warned that they’ll be checking all cars for insurance every 15 days; so make sure you’re covered or be prepared to drain your wallet!

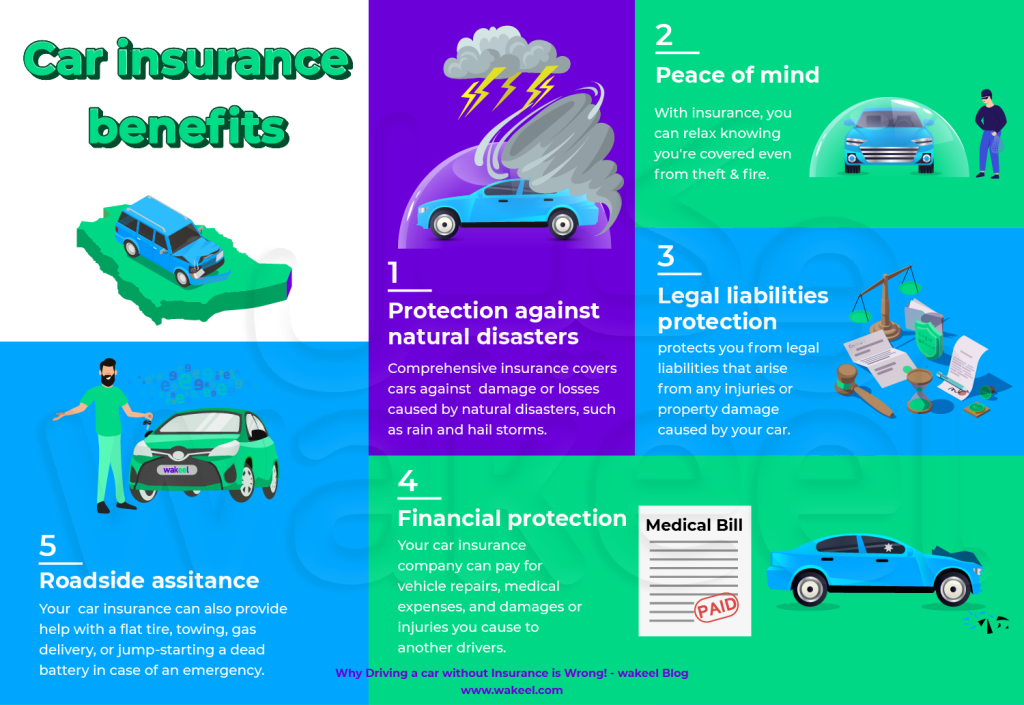

While it might seem like an extra expense, there are several benefits for having it.

Here are the benefits of having car insurance in Saudi 👇

- Car insurance is mandatory because can save you a ton of money if you cause an accident. Repair costs and medical bills can add up quickly, but with insurance, you won’t have to pay out of pocket.

- Dealing with the aftermath of an accident is much easier with car insurance. Najm’s e-services can save you the headache and get things sorted out quickly.

- While not mandatory, comprehensive car insurance offers extra protection by covering damage caused by things like bad weather, fire, theft, or vandalism.

- Comprehensive insurance will also ensure you can rent a car while your damaged car is being repaired after the accident.

- Many insurance companies in Saudi Arabia offer roadside assistance, which can be a lifesaver if you break down in the middle of the road, run out of gas, or get locked out of your car.

Besides, you also need valid car insurance to renew your vehicle registration (istimarah) and pass the annual inspection.

Use Absher to check car insurance details in KSA

Follow these steps to check if your car insurance is still valid:

- Log in to your Absher account.

- Choose Vehicle Services

- Go to Inquiries and select Vehicle Insurance Validity.

- Fill in the required details

- You’ll see if your car insurance is still active.

So, which car insurance do I need in Saudi?

Owning a car entails a lot of financial responsibilities, and there are different ways to protect yourself from the unexpected with car insurance. But how do you figure out which car insurance you need?

Mandatory car insurance

Also known as compulsory insurance in Saudi Arabia or third-party insurance. According to traffic regulations in Saudi, and many other countries around the world, this type of insurance is mandatory for all vehicles. Third-party covers you from liabilities in the event of an accident that will cause injury to a third party. Plus, TPL covers the expenses of repairing others’ damaged cars but, this type does not cover the driver’s personal accidents or cover insured car repair

Tip: If your car is a bit older, it makes sense you consider going with the basic level of insurance.

Comprehensive car insurance

On the other hand, Comprehensive insurance works to protect the driver, their car, and others. In detail, comprehensive car insurance covers any loss or damage to the car as a result of accidents and may also cover car breakdowns resulting from natural perils such as hails and floods.

Does comprehensive car insurance cover all claims? While the name suggests, comprehensive – no policy can grant covering you 100% in all situations!

Tip: For your brand-new car, invest in comprehensive car insurance if you want to full protection.

The best insurance policy will rarely be the cheapest insurance policy you can find. Rather, it should be the cheapest policy that provides the coverage you need for peace of mind without any surprising payments.

Comparison websites will help you find the right car insurance

Instead of giving yourself a headache trying to compare car insurance prices yourself, try a licensed comparison website. A comparison website will help you get free quotes and compare different options from multiple car insurance companies in Saudi Arabia. You can do it all online without any hassle. A website like Tameeni, Bcare, or wakeel will help you find cheap car insurance prices for the insurance you need for your car.