Will my car insurance cover a Hit & Run in Saudi?

Until it happens to you, it can be hard to believe there are people who will hit your car and keep driving as if nothing happened! In Saudi Arabia, if you damage a car and don’t report the accident to Najm or Moroor directly, that’s officially a hit-and-run.

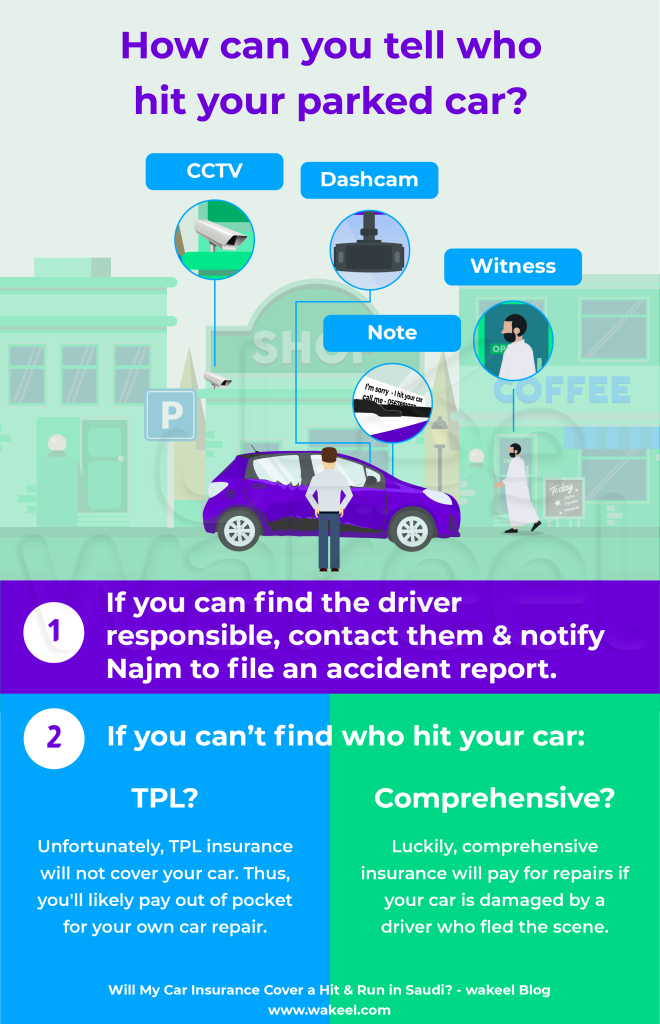

Hit and run car accidents are bad enough when you’re behind the wheel, but they’re even worse when you walk back to your parked car and find a dent with no note and no contact number!

👇This guide covers how to handle a hit and run accident in Saudi Arabia & how your car insurance can help with repairs.

Compare Car insurance quotes

🔍 Hit and Run: What You Need to Know

- Failing to stop after an accident is illegal under Saudi Traffic Laws.

- Najm does not handle hit-and-runs. You must report the accident to Moroor to open an investigation.

- Hit-and-run drivers have to pay a fine of 10k Saudi Riyals.

- Moroor laws assigns the runaway driver 100% fault & they’ll be responsible to pay all the expanses; not their car insurance!

- Excuses like being in a rush, scared, or having expired license or expired car insurance — won’t cut it!

- Even if there’s no sign of the driver who hit you, you’d still be able to repair your car if you have comprehensive insurance.

A car hit my car and then ran away. What happens next?

Step 1: Get the other car’s details

Whether you were there or not when the accident happened, the first thing you need to do is get the car’s number.

You can ask anyone on-site for the car’s number plate or check for CCTV cameras nearby if you weren’t there.

💡 Get a dash cam!

Dashcams are there to help provide you with security and proof in case of an accident

Step 2: Report the accident to Muroor

To report a hit-and-run accident in Saudi Arabia, call Muroor instead of Najm. Najm only handles accidents where both parties are present. For hit-and-runs, you must contact Moroor (Traffic Department).

Step 3: wait to hear back from Muroor

After a hit-and-run accident, Moroor will attempt to contact the other driver 3 times.

If the driver does not respond, don’t worry — the law is on your side! The other driver will automatically be assigned 100% fault and held responsible for paying all expenses.

How to get your car fixed after the accident

Best case scenario: Moroor gets a hold of the other driver

As soon as Muroor holds the other driver responsible, they must pay the amount set by the Taqdeer report.

If you have comprehensive insurance, the smartest move is to approach your insurance company.

Why?

- You don’t have to wait for the other driver to pay

- No waiting, chasing, or excuses.

- The company handles collecting the money from the other driver on your behalf

This is the stress-free option—your car gets fixed fast, and the chasing becomes someone else’s problem.

Worst case, the driver never answers

If Moroor calls the driver three times with no response—or if the driver denies everything—this is what you can do:

A. Use your comprehensive insurance

With comprehensive car insurance, you can approach your insurance company to repair the car, and they’ll handle everything (even if the other driver never answered Muroor’s calls)

- Just keep in mind that you’ll likely have to pay a small deductible, while your insurance company pays the rest of the repair costs.

Will my car insurance price increase after a “hit and run”?

Yes, a hit-and-run claim can increase your car insurance. The best thing you can do to get cheaper car insurance next year is to compare insurance prices and switch companies when renewing.

B. file a case in court through Najiz

if you only have third party car insurance, the best thing you can do is: Get a repair permit from Absher, pay for your own car repairs, and later start a legal case through Najiz to get that money back.

The bottom line

When it comes to hit-and-run accidents, the difference between stress and relief often comes down to one thing: what type of car insurance you have.

Having comprehensive car insurance gives you options, flexibility, and peace of mind—especially when the other driver is not cooperating.

Don’t pay for someone else’s mistake!

Get the best comprehensive cover that protects you from hit-and-runs.

Try wakeel to compare and find the best comprehensive car insurance in Saudi Arabia — and choose coverage that truly has your back.