What is Deductible in Car Insurance?

Many car owners buy car insurance as a formality without giving it a thought, while there are many things you need to look out for when you’re buying comprehensive car insurance in Saudi. So, to make a wise choice for yourself, you have to be knowledgeable about insurance and its jargon in the first place. A deductible is one such jargon most often used in health and car insurance, but what exactly is it, and when do you need to pay it? If you are confused, don’t worry – we are here to make car insurance deductible simple!

What Is Deductible?

In car insurance, a deductible is a fixed pre-decided amount you have to pay when you raise a claim. Normally, insurance companies set this amount in the policy table. The deductible amount often ranges between SAR 500 to 400 or more.

For instance, let’s say you just got your car insured and agreed to set 1000 SR as your deductible. Then, unfortunately, the car gets in a wreck and needs 6000 SR in repairs. Here, you must pay the agreed amount (1000 riyals) before the insurance company bears the remaining costs of 5000 riyals.

At first, it might sound unfair pay out of your own pocket – what’s the point of having comprehensive car insurance, right? In reality, without the deductibles, your insurance payouts would skyrocket, so it’s important to strike a balance.

Why Do Comprehensive Policies Have Deductibles?

Oftentimes, with a comprehensive insurance policy, policyholders have the peace of mind of knowing the insurance company “has their back” all the time. As a result, some may have the urge to drive recklessly or neglect road safety. So, without any deductible or share to pay, policyholders feel they don’t have skin in the game putting the risk solely on the insurer. In effect, deductibles show your responsibility; to mitigate the risk of loss.

When Do You Pay Deductible Car Insurance?

Generally, deductibles only apply to comprehensive claims to cover your own car from accidents. Thus, compulsory insurance (TPL) policyholders are not responsible for paying any additional costs. Meanwhile, if you opt for a comprehensive insurance policy, you must pay the pre-agreed amount before insurance starts repairing your car.

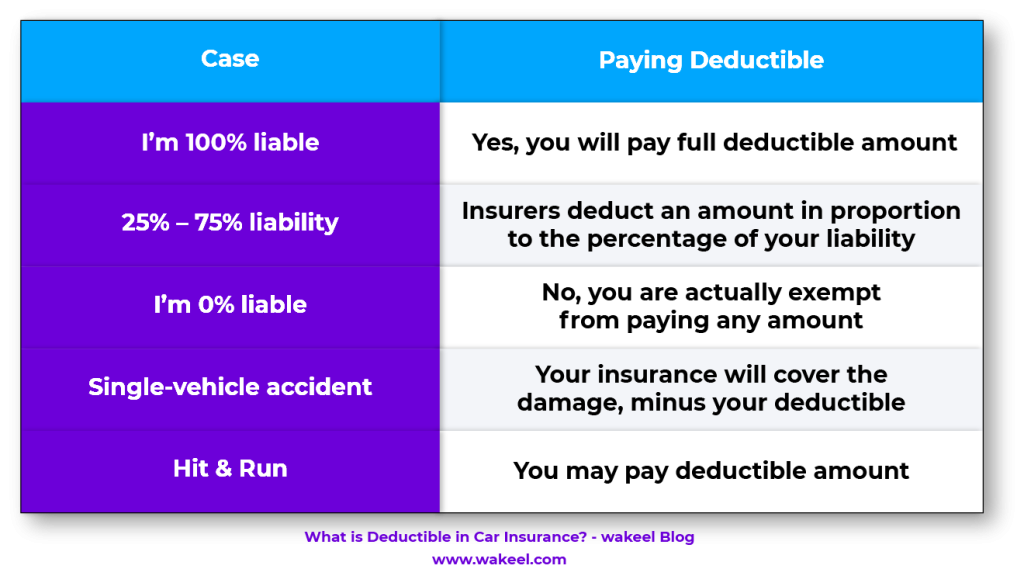

- I’m 100% liable: yes, you will pay a portion of the total costs, while your car insurance company will bear all the remaining repair costs.

- I’m 0% liable: No, you are actually exempt from paying any amount. The at-fault driver’s insurance company will pay the full costs of repairing your car and medical bills.

- 25% – 75% liability. In this case, insurers may deduct an amount in proportion to the percentage of your liability. eg. If you are 25% at fault, you will only pay 25% of your deductibles.

- Single-vehicle accident. Assume you hit a tree or a fixed object — if you take responsibility for the damage, your insurance will cover the damage, minus your deductible.

- Hit & Run: One day you find your side mirrors broken, or a dent in the driver’s side door, but you see no one at the scene.

In this case, if the price of fixing your bodywork costs less than the deductible, and you have the cash. Filing a claim may not be a good idea. Although this means you’ll pay out of pocket, this ensures your insurance rates will stay the same next year. Besides, you can keep your NCD!

Should I Have A High Deductible or a Low Deductible?

When shopping for car insurance, you have to pay attention to two numbers: deductibles and policy price. Now, most people ask: should I have a higher deductible or higher premium?

- Higher deductible: this is a sign of sharing risk and responsibility. Therefore, when you opt for paying a higher deductible, your car insurance rates will be lower. This is a good option for young Saudi drivers to find affordable car insurance prices in Saudi.

- Low deductible: Some insurance companies might even offer zero-deductible, which means they will pay for the full cost. However, if you opt for a lower deductible, you will be left with an expensive car insurance price to pay. Unless you haven’t been involved in a car accident in a long, long, long time; you might want to skip this option.

As of November 2020, SAMA announced that leased cars’ owners can opt for the deductible amount themselves.

4 Things to Remember About Car Insurance Deductible

- Choose a deductible you can afford: If it’s too high, you might find yourself struggling to cover your share of the cost in the event of an accident.

- Consider your car’s value and how much your spare parts could cost.

- Remember insurance is intended to safeguard you in the event of a financial setback, rather than covering minor losses you can pay out of pocket easily

- Compare car insurance prices and deductibles before making a purchase.

Strike the right balance with a price comparison website help

All in all, picking the right deductible is a personal choice based solely on your own budget. It’s important to strike an even balance between your car insurance rates and deductibles. Remember, the lower your deductible, the higher your rates will be. So, before making a decision, it’s worth taking the time to explore your options and compare different car insurance offers. One effective way to do this is by using a price comparison website, which allows you to easily compare comprehensive car insurance plans from various providers in Saudi Arabia.

By using a price comparison website, you can gain access to a wide range of insurance options tailored to your needs. These websites provide a user-friendly interface that allows you to input your specific requirements and preferences. Within seconds, you’ll be presented with a list of comprehensive car insurance plans, along with their coverage details and premium rates. Start comparing car insurance offers in Saudi online today and secure the coverage that gives you peace of mind on the road