How to Claim Bodily Injury From an Accident

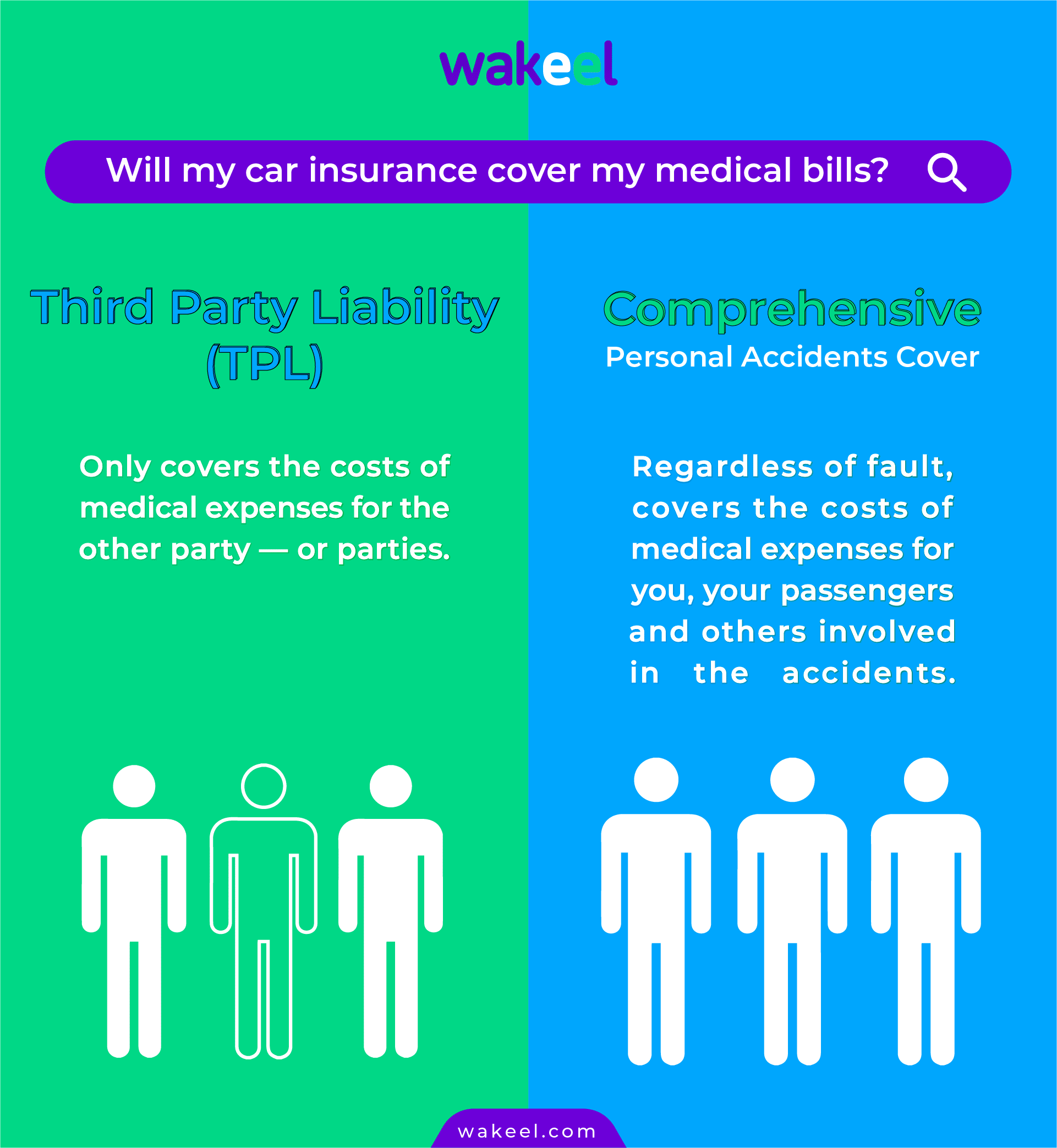

Car accidents happen any day, anywhere, and sometimes even despite all precautions. Overall, they occur due to many circumstances. But, there’s one thing they all have in common: all accidents leave you with unexpected bills to pay! These expenses arise from car damage as well as bodily injury — Even a seemingly minor accident can lead to huge medical expenses. And while you can’t always prevent accidents, you can get help to make them less expensive and stressful. Hence, all drivers in Saudi must carry third-party or comprehensive insurance.

This blog will help you understand how to claim injury after a car accident in Saudi.

What to do after a car accident

In the event of a car accident, you will need to take the right steps and precautions to ensure everyone’s safety and minimize complications down the line.

- Check for bodily injury — the most important first step you can take is to make sure everyone is safe.

- Dial 977 for an ambulance, if anyone is severely injured.

- Report the accident — call Muroor (993) or Roads Security (996) to report the accident.

- Wait until help arrives. Be careful! If you leave the scene before that, you may face hit-and-run charges.

Once everything is settled, review the accident report and your insurance policy coverage before you file a claim & read our “What to do after a car accident in Saudi to claim insurance” guide.

Does car insurance cover bodily injury in Saudi?

Yes, car insurance in Saudi Arabia covers bodily injuries resulting from traffic accidents for insured individuals, including drivers, passengers, or pedestrians. This compensation typically includes medical expenses, treatment costs, and compensation for permanent disability or death (known as “diya”).

Before filing an insurance claim for a bodily injury, you need to understand your insurance coverage and how your accident liability might influence the compensation you receive.

What does bodily injury compensation include?

Generally, bodily injury compensation in Saudi covers the following:

- Medical and surgical treatment expenses.

- Compensation for temporary and permanent disability.

- Compensation for lost wages and income.

- Blood money, in case of death as a result of an accident.

The bodily injury claim process in Saudi

The bodily injury claim process in Saudi Arabia is more complex than other car insurance claims because it requires seeking compensation through the court system. Here is a general overview of the process:

Start a Lawsuit in Traffic Courts

File a traffic lawsuit using the efficient “Najiz” system, allowing for electronic submission of legal claims. Clearly outline the accident details and resulting injuries, seeking compensation for damages.

Submit All Medical Reports

Present detailed medical reports as crucial evidence to support the extent of injuries sustained in the accident. These reports should encompass diagnosis, treatment history, and any ongoing medical complications. If needed, the court may refer the injured to a public hospital for a thorough medical assessment.

Undergo Expert Evaluation

After presenting medical evidence, the court will appoint an expert to assess the nature and severity of the injuries. The expert will issue a medical certificate determining the appropriate compensation amount.

File a Claim to the Insurance Company

Following the court’s judgment, file a compensation claim with the insurance company of the responsible driver. The insurance company is obligated to cover the compensation awarded by the court

If an insurance provider delays or denies payments, you can submit a complaint to the Insurance Authority in Saudi. Alternatively, if the issue is not resolved, you can get in touch with the Ombudsman Center in Saudi. Learn more about insurance disputes in this blog!

Can insurers refuse bodily injury claims?

Under all circumstances, insurance companies must pay for any costs that emerge when you harm a third party. But, yes, an insurance company can deny compensation if the injury falls outside the coverage specified in the policy. Mainly, car insurance policies will not cover accidents that happen as a result of violating traffic rules like red light running or drifting. Of course, each insurance policy is different. So it’s important to read and compare policies carefully to know exactly what is and isn’t included!

Stay safe, stay insured

For everyone’s safety, keep a first aid kit in your car; A well-stocked first-aid kit can help you respond effectively to common injuries and emergencies! By the same token, make sure you have adequate insurance coverage too. Compare car insurance policies and quotes instantly online in Saudi.