Car accident in Saudi: How do you get your insurance money?

If your car is in an accident, you will want to make a claim on your motor insurance. This blogs tells you what you need to know after getting into a car accident in Saudi, and what steps you should follow to repair your car or get your insurance money.

First things first, what are the accident rules in Saudi Arabia?

First things first, what are the accident rules in Saudi Arabia?

Stop your car and make sure you and the other driver(s) are okay. It’s not just human decency, and it’s also a must. Drivers who don’t stop after a car accident in Saudi Arabia will face “hit-and-run” charges.

Call Najm, if at least one of you has car insurance, Najm will provide the accident report and help you file a claim online.

Call Muroor, if no one has car insurance or if someone gets hurt.

Act FAST if your driving license has expired! Car insurance companies in Saudi give you 50 days after the accident to renew it. If you don’t, you’ll have to pay them back for all the repairs.

Get everything OFFICIAL, if you both agree to just handle paying for car repairs yourselves (no insurance needed!) Use Absher’s Accident Waiver service.

DO NOT leave the scene without an official accident report if your car is leased. Why? Because the bank owns the car, not you! You have to file a claim with the insurance company, or you could find yourself in a whole heap of trouble later. So, don’t risk it!

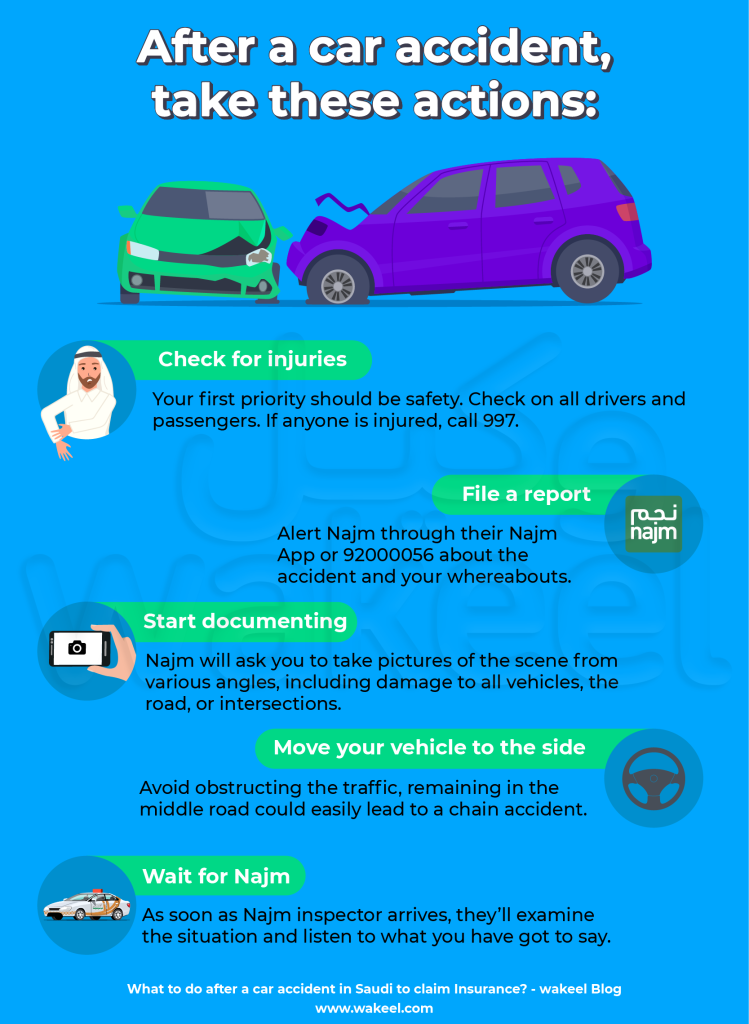

Here’s what to do after a car accident

#1 Report the accident

- If at least one driver has car insurance policy, contact Najm via WhatsApp at 920000560 — or report the accident through the Najm app (available on Apple and Android devices).

- For serious accidents (injuries, runaway driver, no insurance) contact Muroor.

- Even if you don’t plan to file an insurance claim, always get an accident report. Read why you should Never drop a car accident with verbal agreement!

#2 Start the process on Najm app

- Once your case is registered, a surveyor will assess the accident and prepare an official report with the details.

- You can check the accident report status on Najm app. Once it’s ready, use the app’s instructions to claim insurance after the accident.

#2 Go to Taqdeer and get an evaluation

- You book an appointment with a Taqdeer center (optional but helps you avoid long queues)

- Taqdeer assesses the damage to your car and the expected repair cost (parts + labor) and sends you the report within 24 hours.

- Taqdeer service isn’t free, the at-fault driver’s insurance pays the Taqdeer fee

Quick tip

If you end up needing a tow truck to move your car to Taqdeer, the evaluation center, hold onto that invoice. Upload it with your insurance claim to make sure you get compensated for it.

#4 File your car insurance claim online

- After that you file a claim to the insurance company through Najm and you’ll need to provide your bank information (IBAN) and all the documents related to the accident.

#5 Get your insurance money

- After your claim is approved, you should receive your insurance money within 15 working days. Then, choose your repair shop.

- If the company takes more than 15 days with no valid reasons you can, you have the right to file a complaint — and even escalate it to the insurance regulator in Saudi, the Insurance Authority.

Does car insurance go up after an accident?

Even if you weren’t at fault, you’ll notice that your car insurance quotes got more expensive after an accident. That’s because car insurance companies in Saudi Arabia see an accident as a red flag, suggesting that you are more likely to be involved in another accident!

Plus, making a claim could also mean losing your no-claims discount. If you see an increase, don’t just accept it. Shop around! Comparing quotes from a range of different companies is one of the best ways to find a cheaper car insurance deal.