When to Update Your Car Insurance Details

To get a car insurance quote, insurers typically ask you to provide identifying information such as your name, age, the type of car you need to insure, etc. This kind of information reflects what the insurer believes is the likelihood you will make a claim in order to determine premiums. With that being said, The phrase “honesty is the best policy” best describes how you should answer any question your insurance company may ask. Do not give any misleading, false, or incomplete information or conceal important and material information when buying car insurance. Furthermore, you should also be aware that failing to update your insurance details; especially material information results in major negative repercussions.

Not sure when you should update your insurance details? Take a look at the top reasons to notify your car insurance company.

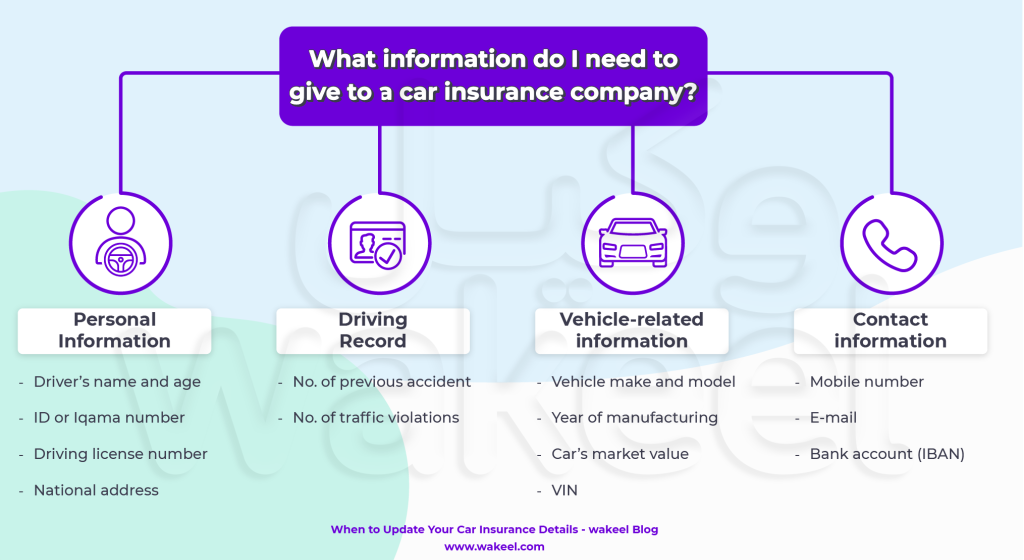

What information do I need to give to a car insurance company?

- Personal Information. Insurance companies require providing the following data for every named driver:

- Driver’s name and age

- ID or Iqama number

- Driving license number

- National address

- Medical conditions that affect driving

- Driving Record.

- Number of previous traffic accidents

- Total traffic violations registered in the name of the driver

- Vehicle-related information. Such as:

- Vehicle make and model

- Year of manufacturing

- Car’s market value

- Car plate number or customs card number in case the car is imported

- VIN

- Purpose of use

- Seating capacity

- Engine power

- Mileage

- car color

- modifications to the vehicle; Including accessories, body modifications, and mechanical or cosmetic modifications.

- Contact information, namely:

- Mobile number

- Bank account (IBAN)

When should you update your car insurance policy?

You should contact your car insurance company if you:

Buy a new car

Some car insurance companies in Saudi, like Al Rajihi, allow you to insure two or more cars on a single policy. In short, these insurance policies offer the same features as any typical policy but give you a discount when you add another vehicle. This makes it one of the cheaper ways to insure more than one car. See, this is why It’s always a good idea to shop around and compare car insurance quotes before buying insurance.

So, if you decide to buy a new car see with your insurance company if they offer a similar discount and be sure to update your details.

Cancel vehicle ownership

Legally, Saudi laws require insurance for all registered vehicles — This also applies to cars in storage or out-of-use cars. Even if you aren’t driving it, you need to keep your car insurance if the vehicle is still registered in your name to avoid penalties or losing your NCD.

However, if you decide to cancel vehicle ownership or transfer vehicle ownership, it’s best to let your car insurance company know. If you cancel your insurance, your insurance company will issue a refund of any premiums you’ve prepaid.

Change names

On average, 240 Saudis legally change their names every month, that average out to 14 people per day! In many instances, the legal process of changing your name could actually be the easy part; Right after changing your name legally, you still have to update all your legal documents one by one.

Any changes to personal information, such as your legal name have to be changed on both your car insurance and your driver’s license. If the personal information on your insurance policy is incorrect, there may be problems if you ever need to make a claim. Having incorrect information on your policy can also even be considered fraud in some circumstances.

Change contact information

Similarly, you also need to change or update your insurance policy number, if your contact information or banking information has changed.

Whenever you change your e-mail, phone number, bank account, etc., it is essential to make sure you also update your information with your insurance company. If they don’t have a reliable means of contacting you, you could miss important notifications regarding your claims status or policy issuance/expiration.

Fortunately, many insurance companies in Saudi Arabia allow their policyholder to change or update contact information online or by calling customer service representatives.

Add/ Remove insurance coverage

Taking extra insurance on and off is a common occurrence on comprehensive insurance policies. In fact, you can make changes to your insurance coverage at any time throughout the year.

For example, sometimes you just need to change the coverage on your existing policy. Maybe you are dropping roadside assistance from your insurance because your warranty already covers that. Other times, you may actually need to extend your insurance to Bahrain. Simply call your insurance company to update your insurance coverage.

Changes in the material fact

In car insurance, a “material fact” is any information about the policyholder or about the car that would reasonably have a significant effect on the price of car insurance, or the insurer’s decision to cover the car. For example, how you decide to use your car is one of the most important factors that can affect the price of your car insurance.

Typically, insurance only covers accidents that occur while you’re driving your vehicle for personal use. You’re on the road longer. You’re distracted looking at the app sometimes. All these factors increase the risk of being in an accident. Thus, your best bet is to be upfront with your insurance company about the fact that you’ll be “driving for hire.”

Many don’t even realize that this is a necessary step but it’s important to notify your insurance company within 20 working days about any change that could increase the risk. Otherwise, you may have to pay out-of-pocket for any legal, repair, and medical costs.

To name a few, here are several examples of material facts that you must give to your insurance company:

Moving & Changing address

If you decide to move homes, one of the things to add to your moving to-do list is to update your address on your insurance policy. Your address holds key information for insurance companies on the risks you face as a driver and car owner; So, your national address can affect your car insurance.

There can be some serious problems if you don’t notify your insurer about your address update. For example, your claim could be rejected, and it could even be considered to be insurance fraud; because some people use different addresses to lower their insurance.

Medical conditions

Normally, it’s up to the General Traffic Department to evaluate drivers’ ability to drive safely and place driving license restrictions. But, if you develop a health condition or disability that might affect your ability to drive later, it’s important to tell your car insurance company.

Some of the medical conditions that may interfere with safe driving include:

- Diabetes

- Epilepsy

- Visual impairment, such as glaucoma and cataracts.

Moreover, you should also inform your insurance company if you drive a car that’s been specially adapted to meet your needs. Usually, modifications and accessories require higher costs of repairs.

Business use of car

Nearly all car insurance companies will deny paying out on a claim you were driving the car for business-related reasons unbeknownst to the insurer. As a matter of fact, SAMA’s Unified Policy states, “Insurance companies have the right of recourse against the policyholder if they provide incorrect information or concealed material facts.”

To avoid claim rejection or complications, it’s best to update your “Use of Car” details first.

Car modification

If you’re planning to change anything about your car — whether for enhancing its looks or performance, — it’s essential to inform your car insurer beforehand. In most cases, modifications in a car can increase its risk of an accident or increment its value.

If you fail to update your insurance company, the custom elements may not be covered, and any repairs or part replacements will be your financial responsibility

Add/remove an additional driver

Another important reason to update your insurance policy is adding or removing a driver. If you have Comprehensive or TPL insurance, the policy only covers the drivers whose names are specifically listed. Adding another driver to your car insurance will give them coverage whenever they drive your car.

Ordinarily, policyholders add their family members or private drivers to their insurance. If you want to add a driver, to your insurance the company will need the driver’s name, date of birth, driving history, and license information. Later, if that driver no longer drives your car, you can ask your insurance company to remove their name from your car insurance policy.

Bottom line, it’s important to keep your policy info up-to-date

All in all, prior to finalizing a quote, insurance companies collect use information related — and unrelated — to one’s driving record to rate risk profiles and price policies. To avoid any unnecessary complications, it’s important to give out correct information and update your policy details whenever needed.