Car insurance & fire damage in Saudi Arabia

Fire can cause a whole lot of damage to a car — sometimes leaving it completely destroyed. So, it’s only natural to ask, “Does car insurance in Saudi Arabia cover fire damage?” The short answer: Yes, insurance will pay if your car is burnt down — but only if:

✅ You have the right vehicle insurance

✅ There’s proof that the fire was accidental.

Below are the answers to everything you need to know about fire & car insurance in Saudi Arabia.

Compare Car insurance quotes

Car on fire: will my car insurance pay?

In Saudi Arabia, only comprehensive car insurance covers damage related to fire. Third party insurance, on the other hand, it won’t cover any damage to your car—even in situations beyond your control, like a fire.

💡

If you want fire protection at a cheaper price, look for third party plus options when you compare car insurance prices online in Saudi Arabia!

Insurance process if a car burns down

You need to submit a claim to your insurance company with the Civil Defense report attached.

In most fire accidents, the car is completely destroyed — what insurance companies in Saudi Arabia call a Total Loss. A total loss means your insurer will pay you the car’s value as listed in your policy.

But before getting your insurance money, you must:

- Transfer ownership of the car to the insurance company.

- Cancel vehicle ownership through Absher.

After you provide the insurance company with proof that Steps 1 and 2 are done, they will transfer payment directly to your bank account.

Car insurance companies in Saudi Arabia are extra careful with fire claims

Insurance companies cannot process or pay any fire-related claim without an offical report from Saudi Civil Defence. Because its main proof your insurance company will rely on when deciding whether your fire was accidental or intentional.

Because sometimes, owners try to set their car on fire, hoping to get insurance money or escape their car installments.

Also, if the fire was started on purpose or caused by extreme recklessness, it becomes a criminal case. Since car insurance never covers damage linked to criminal activity, the company needs the official report to trace the cause and responsible party.

🔧 Know & avoid the causes of car fires

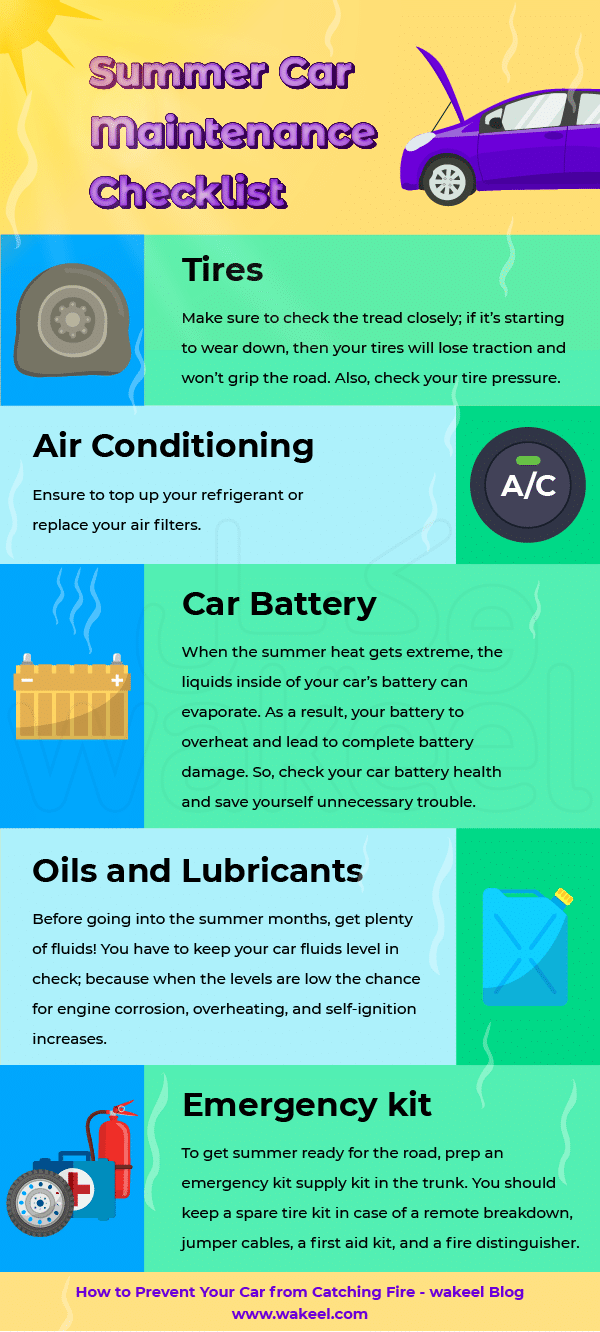

1. Don’t skip maintenance

The most common causes of car fires are electrical and mechanical problems. Mechanical failures can generate heat that can start a fire or cause flammable fluids to ignite. So, stay on top of your car maintenance to catch problems early.

👉 Check recalls.sa to see if your car has any open recalls — some recalls are directly related to fire risks.

2. be careful with car modification

Doing any electrical work or adding non-standard accessories to your car can also increase risk.

3. watch the heat

Never leave things that can explode (like lighters, spray cans, or electronics) in a car; especially during hot summer months in Saudi Arabia. These items can explode or catch fire under extreme heat.

Be ready, not sorry

It’s a simple truth: you can’t always stop a bad thing from happening. But you absolutely can be ready for it and having the right car insurance can make a very bad situation a little better.

And remember, you don’t have to spend hours searching for the best car insurance. You can easily compare car insurance prices for comprehensive, third party and third party plus in Saudi Arabia online