Impact of Depreciation on Car Insurance

This blog is regularly reviewed to ensure that our content is up-to-date and accurate. SAMA Issued an update to the Comprehensive Insurance rules: Deprecation rate will not be deducted from the compensation amount. For more information, refer to Comprehensive Insurance Rules.

There’s no escaping the truth — everything is bound to lose its shine and luster through everyday wear and tear. Over time, the value of a product or an item decreases no matter how valuable or expensive it used to be. This is commonly known as depreciation. Consider this: if you bought the latest phone for 5,000 SR today, and then sold it two years from now. Would you be able to get your 5,000 SR back? Of course, not! After 2 years it will not be as good as new. Another example is your car. As each part of the car wears out with time, the value of your car also diminishes. This has a direct impact on your car insurance in Saudi too. Depreciation can directly affect the compensation you receive for damages or replacements.

What is depreciation?

Depreciation refers to the decrease in the value of a car over time. Imagine buying a brand-new Hyundai Sonata for 143,100 SAR. As soon as you drive it off the dealership lot, it begins to lose value. Let’s say after a year of use, the market value of that car drops to 121,635 SAR. The difference between the initial price (143,100 SAR) and the current market value (121,635) represents the depreciation, which in this case would be 21,465 SAR.

How quickly do new cars lose value?

“New car price value can fall at an alarming rate,” says financial expert David Bach. The moment you drive it off the lot, it begins to depreciate. In just five years, it can shed over 60% of its initial worth.

What does depreciation refer to in a car insurance policy?

Depreciation directly impacts the amount you receive in a claim settlement. When your car sustains damage or requires replacement parts due to an accident, insurance companies in Saudi consider the depreciated value of these parts. For instance, if a five-year-old car needs a new bumper after an accident, the insurer won’t cover the cost of a brand-new bumper. Instead, they factor in the depreciated value of the bumper based on its age and condition. This means you might receive a lower payout than the cost of a new bumper due to its decreased value over time.

What causes car depreciation?

All cars depreciate: new or old, but there’s one thing that’s always true: New cars depreciate faster than used cars. As a result, many prefer to buy second-hand cars – here’s a guide to transfer car ownership in Saudi

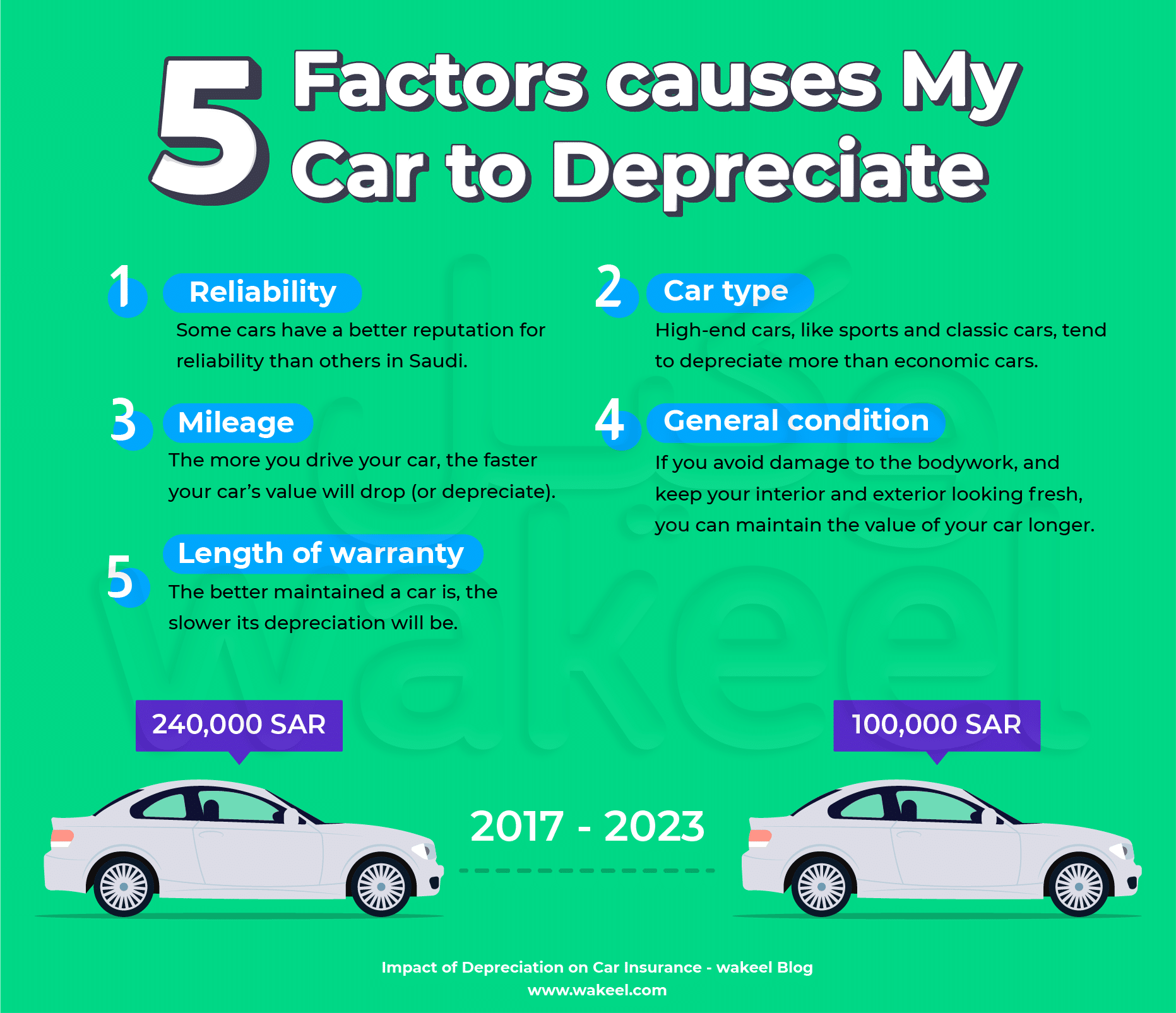

In essence, many factors go into how and why cars depreciate and they’re the same things to avoid when buying a used car:

- Mileage: with gentle use, you can expect to keep most of your car components longer. On the flip side, the more you drive your car, the faster your car’s value will drop (or depreciate).

- Reputation: car brands and models that are popular in KSA hold up better over time. Also, if you were to buy a second-hand car, you’d be looking for a car that has some durability in it. That makes sense, right?

- Length of warranty: warranty guarantees reliability. Remember, the better maintained a car is the slower its depreciation will be.

- General condition: if you avoid damage to the bodywork, and keep your interior and exterior looking fresh, you can keep the price up.

- Car type: high-end cars, like sports and classic cars, tend to depreciate more than economical cars simply because they have higher bills for parts and maintenance.

- Total loss: when your car is damaged is beyond repair, your insurance company will pay upfront in cash the current value of your car in the market.

- Partial loss: when your car parts need replacement, your insurance company will deduct an amount for depreciation as specified in your policy table.

Accordingly, it’s important to examine and compare car insurance policies carefully. Pay attention to a few numbers such as premium, deductible, and depreciation.

Zero Depreciation Car Insurance

As far as large purchases go, a car for most people is a major purchase. Some people might save up for years, others might get a loan or lease to own to buy a new car. To, protect your assets and curb your expenses, buying car insurance is a must. But if you’re looking to get the most out of your insurance; then, consider zero depreciation cover. Especially if you’re:

- a new car owner

- driving a new car

- driving an expensive or high-end car

In such cases, it’s a good idea to avail of zero depreciation coverage in your comprehensive insurance. With the help of it, you get full reimbursement during the time of claim and get to keep your car in its original value for a longer time.

Looking for affordable car insurance?

Don’t overlook the power of comparison—Start comparing car insurance prices today to ensure you’re getting the coverage you need at a price that suits you best. Your car and your wallet will thank you!