4 Effective Ways to Save on Car Insurance in Saudi

We’ve all experienced the tiresome, repeated searching when trying to find cheap car insurance prices in Saudi. With continually fluctuating prices, it seems like you’ll be paying more — a lot more — for car insurance every year when your policy renewal notice arrives. So, here are some key tips that will save you time, frustration, and most importantly money when renewing your TPL or comprehensive car insurance the next time!

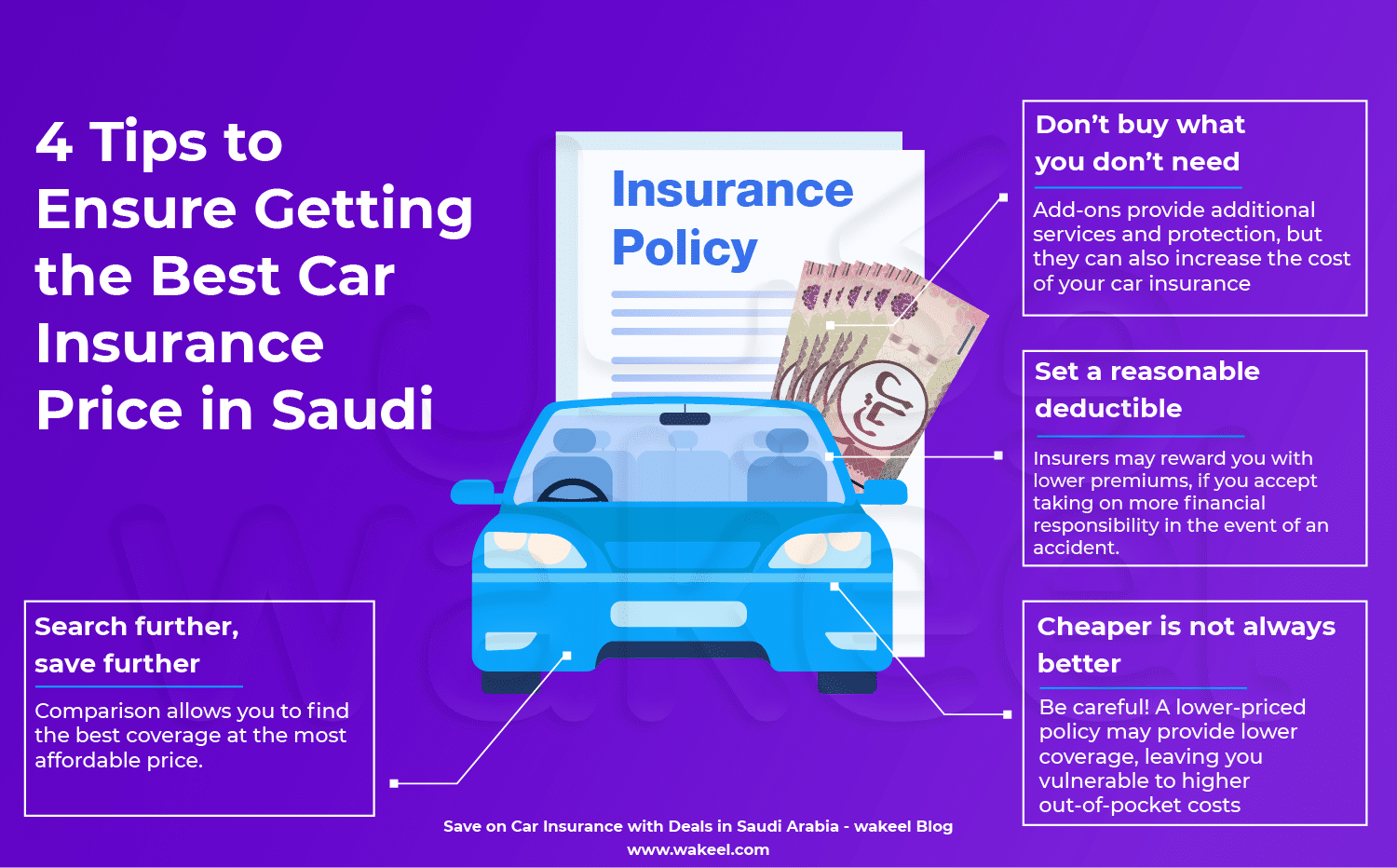

How to secure the cheapest car insurance prices in Saudi

#1 Shop around and compare car insurance prices

Car insurance prices vary based on location, demographics, number of car accidents, type of car and even from one company to another!

If you’ve been with the same company for more than 2 years, it’s definitely time to shop around for new car insurance quotes before your renewal date. You can use an online comparison website to collect and compare qoutes from multiple car insurance companies for you. Compare coverages, compare prices, and choose the option that will give you the most peace of mind!

#2 Drive safely to maintain a good driving record

Some factors that affect car insurance prices, like age or your national address, aren’t always within your control. But a careless at-fault accident or a traffic violation can send car insurance company.

Every scratch-free year adds a dash of discount, and if you manage to keep your record clean for 5 years, you can maximize Najm’s discount to 60% off your car insurance prices.

#3 Drop unnecessary add-ons

The more your car insurance covers, the more you’ll have to pay. Add-ons like GCC coverage, rental car coverage, or roadside assistance can be handy – but they cost extra!

So, before you renew, review your policy benefits and ask yourself: “Do I really need this? Take roadside assistance, for example. You probably got this add-on because you didn’t know how to change a flat tire or because the thought of a breakdown made you panic. If you picked up some mechanical skills or bought a new car, maybe it’s time to let that add-on go! Ditch it and save 600 riyals on your car insurance!

Here are some other add-ons that might be gathering dust in your policy:

- GCC coverage: Unless you spend every weekend in Bahrain or Kuwait, having this add-on may not be worth paying extra.

- Rental car coverage: Own another reliable car? You might be better off saving the cost of this add-on and save your money for when you actually need it.

You could also try to raising your deductible to the highest amount you can afford or switching to TPL car insurance, but having a car insurance that doesn’t cover repairing your own car is almost never advisable.

#4 Ask about discounts

Many car insurance companies in Saudi offer discounts for having a multiple-car policy, or belonging to certain jobs or organizations, or carrying a certain bank card. Be sure to ask about any discounts you might be eligible for.

Skip the hassle and use a price comparison website

Worry not, if you don’t have the time to comb through dozens and dozens of different policies to find a budget-friendly policy! A price comparison website can make it 10 times easier to find cheap car insurance in Saudi. We guarantee you will get access to exclusive deals, discounts, or special offers from insurers that might not be available elsewhere!