What is Deductible in Car Insurance?

For many in Saudi Arabia, car insurance is just another box to check. They compare car insurance online, find the cheapest option, and pay without giving the details a second thought. But to get an insurance policy that truly works for you, not against you, you need to understand one key thing: the deductible.

You may have heard of a deductible with health insurance, but what does it really mean for your car? And when do you have to pay it? Let’s break it down.

Compare Car insurance quotes

What is a deductible, in car insurance?

If your car insurance has a deductible, it means in case of any accident, your insurance will charge you an amount before they process your car repair.

In Saudi Arabia, this amount can be 500, 1000, 7000 riyals or more, and the choice is yours when you buy insurance.

Why does insurance need to charge a “deductible”?

Deductibles is a way to share responsibility. If car insurance covered everything, some people might drive carelessly because they wouldn’t have to worry about anything.

By having a deductible, drivers are more likely to drive carefully, which reduces the number of claims for the insurance company

So in short: deductibles reduce reckless behavior, show that you’re going to be a responsible driver, and lower car insurance prices.

4 Key Facts about deductible in Saudi Arabia

1. You choose your deductible.

When you compare car insurance online, you’ll be given a few options for the deductible amount, from low to high. You can choose the one that best fits your budget.

2. You can’t claim insurance money if it’s less than your deductible.

If the repair cost is less than your deductible, you pay it yourself.

This rule only applies to your own car damage and does not affect what the insurance company pays to other people (third parties) you may have hit.

3. The deductible applies to each accident.

Even if you file multiple claims from a single accident (like one for car repairs and one for injury ), you only pay your deductible once.

4. Your deductible is a fixed amount.

Your deductible stays the same until your car insurance expires. The insurance company can’t suddenly change it based on the type of accident or repair costs.

When do you pay your car insurance deductible?

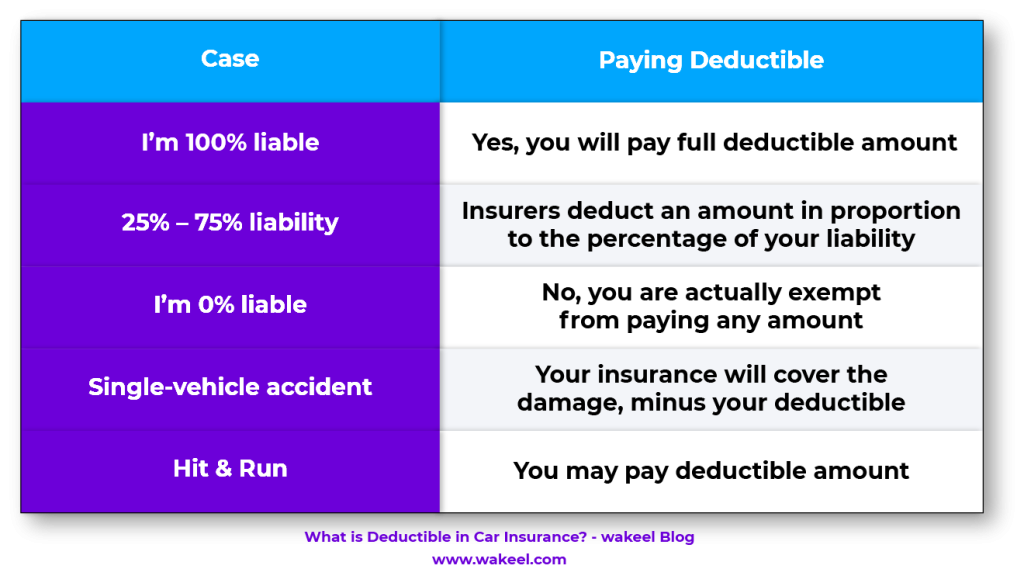

if accident liability is 25%-100%, you pay part of the deductible.

If you’ve any accident liability, you will only have to pay a percentage of the deductible that matches your liability percentage in Najm’s accident report.

Example: 50% liability = pay 50% of your deductible.

if accident liability is 0%, you don’t pay.

You don’t pay anything. The other driver’s insurance will cover the entire cost.

you pay full deductible if there are no other driver.

If you cause an accident and there’s no other driver (like hitting a pole, or a a someone hit the car without stopping), you will be responsible for paying your deductible.

Should I have a 500 or 1000 deductible?

This is where most people get stuck when they compare car insurance online. Should you go for a higher deductible or a lower deductible?

- Higher deductible = lower car insurance price.

You’ll pay less for your insurance overall, but you’ll be charged the high deductible amount when an accident happens. This option is ONLY good if you’re confident about your driving skills and can easily pay that amount without throwing off your entire budget. - Lower deductible = higher car insurance price.

Your car insurance will be more expensive, but you’ll be charged less (or nothing) if an accident happens. This is a good option if you live somewhere busy or have a good Najm discount to help you get cheaper car insurance.

Read this blog for more advice, Don’t be fooled by cheap car insurance—check the deductible!

Don’t just compare prices, compare deductibles too

At the end of the day, the deductible you choose can make a huge difference in both your wallet today and your peace of mind tomorrow. It’s not just about finding the cheapest car insurance in Saudi Arabia — it’s about finding the balance between price and protection that actually works for you. The easiest way to do that? Use an online comparison service where you can see deductible options side by side with prices. That way, you’re not guessing — you’re choosing the coverage that fits your driving style, budget, and lifestyle.