Choosing the Right Deductible for Your Car Insurance

Car insurance companies in Saudi price their comprehensive insurance based on a variety of factors. These factors can be grouped into two categories: those that are within the policyholder’s control and those that are outside of their control. For example, most insurance companies consider age an important factor; because young drivers are statistically more likely to be involved in accidents. Similarly, car insurance companies pay attention to your national address, which can increase the likelihood of accidents occurring due to higher population density and traffic congestion. While age and location might be uncontrollable factors, there are other factors that policyholders can control, such as their car insurance deductible.

Basically, a deductible is the amount of money you agree to pay out of pocket — when you’re at fault — for any damage to your car before your insurance covers the rest of the bill. And, if you raise your deductible amount you can significantly lower your car insurance cost! But, don’t rush into that decision — do everything in moderation. With a high deductible, you are agreeing to pay an additional portion of car repair costs. In this blog, we’ll break down the impact of your deductible amount on your car insurance and help you determine if raising your deductible is worth the potential savings.

Comprehensive insurance deductible explained

According to SAMA’s Comprehensive Insurance Rules, if the policyholder causes an accident, they have to pay a percentage of their vehicle’s repair costs. The deductible amount is calculated based on their liability for the accident, while the insurance company should be responsible for paying any costs beyond the deductible amount.

For example, if you choose a SAR 1,000 deductible and you’re 100% at fault for an accident that causes SAR 5,000 worth of damage to your car, you will pay the first SAR 1,000, and your insurance company will cover the remaining SAR 4,000. But, if the accident report shows you’re only 25% responsible, you’ll only have to pay 25% of your deductible amount. As such, you will only pay 250 riyals.

This might lead us to the next question

Why do you have to pay a deductible if you already paid for my car insurance?

The deductible amount is a standard feature of all comprehensive car insurance policies in Saudi. Think of it as an agreement of sharing responsibility with your insurance company. So, when insurance companies ask policyholders to pay for part of their car repairs, they’re actually asking them to take responsibility by driving safely and taking precautions to protect themselves and their cars against accidents. Ultimately, this mutual agreement between policyholders and their insurers creates a win-win situation between both parties.

Is it better to have a lower deductible or a higher deductible?

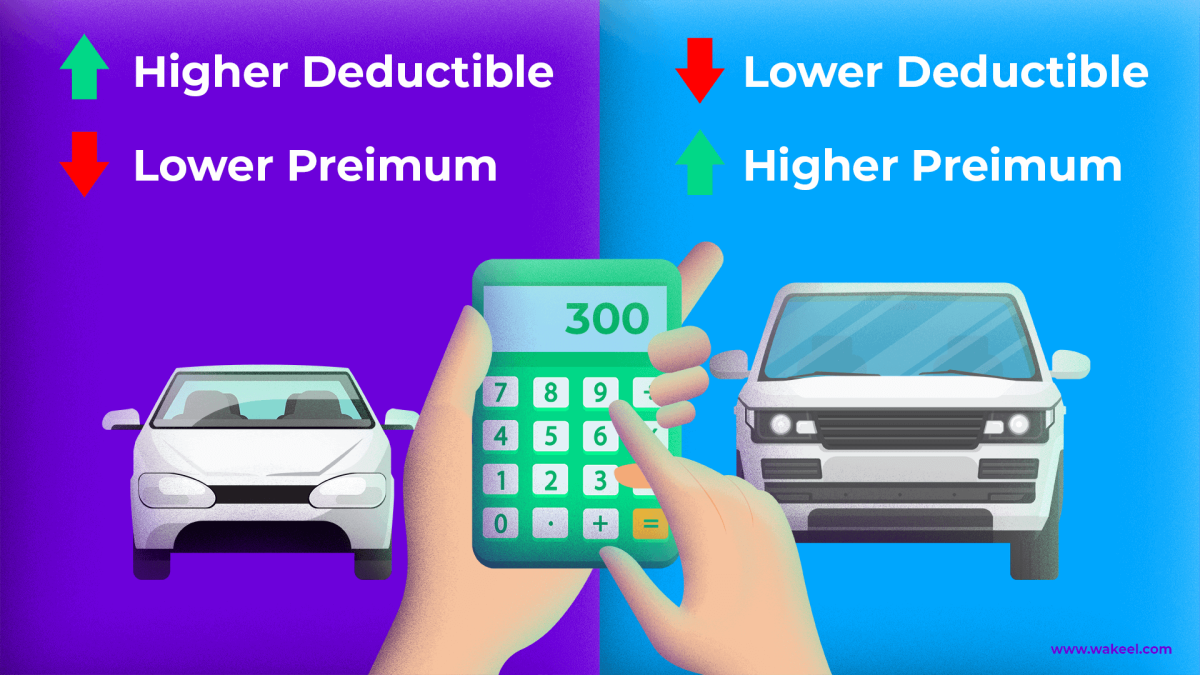

In general, car insurance deductibles and rates have an inverse relationship, which means that as the deductible increases, the premium decreases, and vice versa. So, if you choose a lower deductible, you’ll pay a lesser portion of your insurance claim, but respectively, your car insurance premium will be slightly higher.Regardless,a higher deductible can still lead some drivers to additional costs down the line.

To determine whether increasing your deductible will be financially worthwhile, you need to consider a few things.

4 Things to consider when choosing the right deductible for your car insurance

When you compare car insurance prices, insurers will usually suggest a minimum deductible and a maximum deductible that you can choose from. Here are some things to consider when choosing the right deductible for your car insurance:

Your financial situation

First and foremost, you need to assess your financial situation! Raising your deductible means paying a larger amount as part of a covered claim. As such, it’s important to consider whether you can comfortably afford to cover the deductible if necessary.

If you have enough savings to cover a high deductible, without breaking the bank. Then, increasing your deductible could help you save on insurance. The key here is to never raise your deductible beyond what you could afford to pay toward a claim. Otherwise, a higher deductible could lead to greater financial strain if you’re unable to cover it. Additionally, a higher deductible may not cover minor damages, which could lead to additional costs down the line. Not to mention that it can make you have less peace of mind while driving. Bottom line, if the budget is tight then it’s better to stick to a lower deductible and pay a slightly higher premium.

Your driving record

Your driving records can also play an important role in choosing the right deductible. Statically, high-risk drivers, those with a history of traffic violations and accidents, are more likely to file claims.

Therefore, low deductible insurance may be a better choice for high-risk drivers to avoid any additional expenses. On the other hand, if you’re a safe driver with enough experience, then swapping a higher deductible for lower premiums could pay off! By taking on a greater share of the financial risk, low-risk drivers can often save money on premiums in the long run.

The logic is that you won’t have to file any claims nor pay in claims which could, in turn, help you save more money! Besides, you’d also be eligible to earn Najm’s NCD.

The likelihood of accidents in your area

Similarly, your national address — or rather where you drive your car — can play a role in pricing your car insurance. Mainly because it provides insurance companies with information about factors that impact the likelihood of accidents, theft, and other incidents in your area.

Based on this, it’s best to steer clear of policies with a high deductible if you live in a busy area; as it could end up costing you more money in the long run. In a busy area, there is a higher chance of your car being stolen or damaged due to traffic density. And with a higher deductible, you may substantially increase your insurance costs. Ultimately, it’s important to shop around for insurance and compare car insurance prices from multiple providers in order to find the best offer for your specific situation.

Current car value

Finally, you should also consider the value of your car. Unlike older cars, new cars tend to cost more to insure because of their market value. Additionally, are generally more expensive to repair or replace. The same goes for luxury and sports cars.

When deciding whether it’s worth paying higher premiums for a lower deductible based on your car value, consider the likelihood of an accident and the potential cost of repairs or replacement. If you have a high-value car and the cost of repairs or replacement would be significant, it may be worth paying higher premiums to have a lower deductible and reduce your out-of-pocket expenses. On the other hand, if you have a lower-value car and the cost of repairs or replacement is relatively low, it may make more sense to save money on premiums by choosing a higher deductible.

All in all, car insurance premiums and deductibles tend to have an inverse relationship — meaning that as one increases, the other decreases. When choosing the right deductible, it helps to do the math and compare potential savings to find the ideal balance of premium and deductible expenses because raising a deductible will not make sense in every case.

Keep in mind that increasing your deductible is just one way to cut down on car insurance costs! There are many other ways to save on insurance, the easiest way is to compare your options. Be sure to use a price comparison tool to compare different car insurance offers to see how different deductibles affect your premiums.