Skip the wait! File Your Takaful Al Rajhi Claim in Minutes

Instead of wasting time finding and driving to Al Rajhi Takaful nearest branch, use their online services to submit a third-party or comprehensive insurance claim. It’s quick and easy —no long lines or waiting required!

For a step-by-step guide, here’s how to file a claim online through the Al Rajhi Takaful website.

3 Steps to file a claim online

Step 1: Prepare the documents

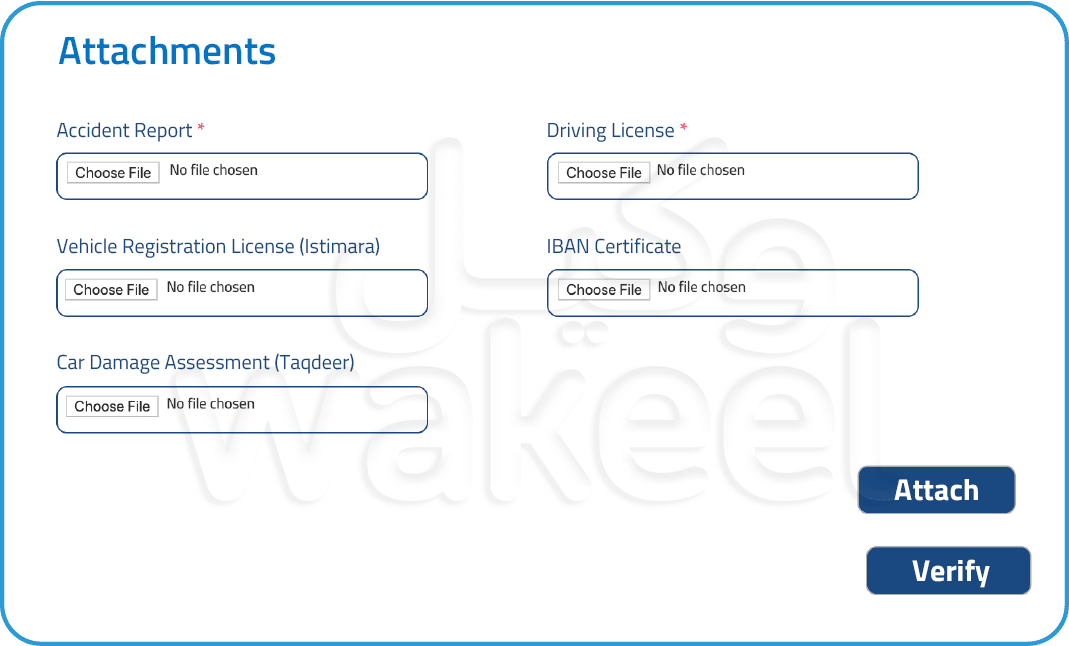

Documents required for car insurance claim

Accident report from Najm or Moroor (Traffic Department)

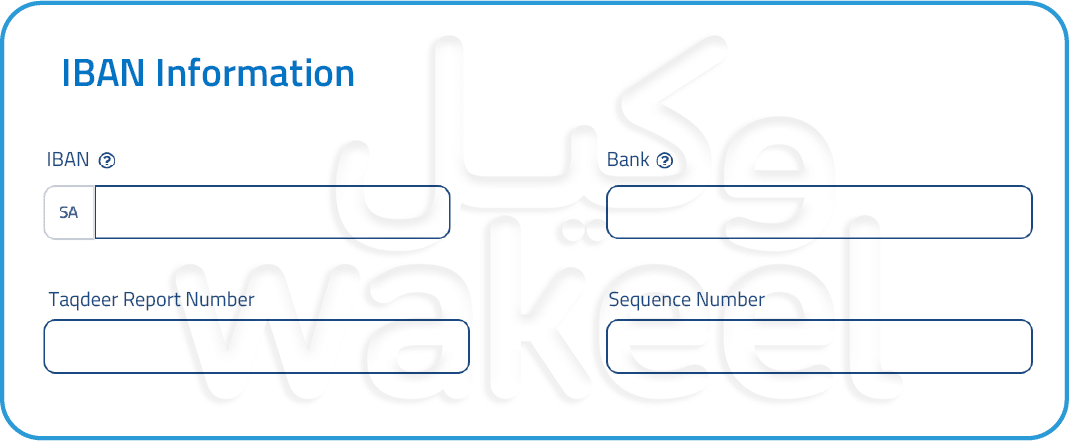

Taqdeer report number (only required if you had the damage assessed at a “Taqdeer” center)

A copy of the driver’s license

A copy of your vehicle registration (Istimara)

Car owner’s IBAN certificate

For bodily injury claims, you’ll also need

Court-issued Arsh (Sharia-prescribed compensation for bodily injury)

Injured person’s ID

For claims involving theft, rain damage, or fire damage:

If your car was stolen, you’ll need a stamped police report.

For rain or fire damage submit a report from Civil Defense.

Step 2: Use Al Rajhi Takaful app/ website to submit your claim

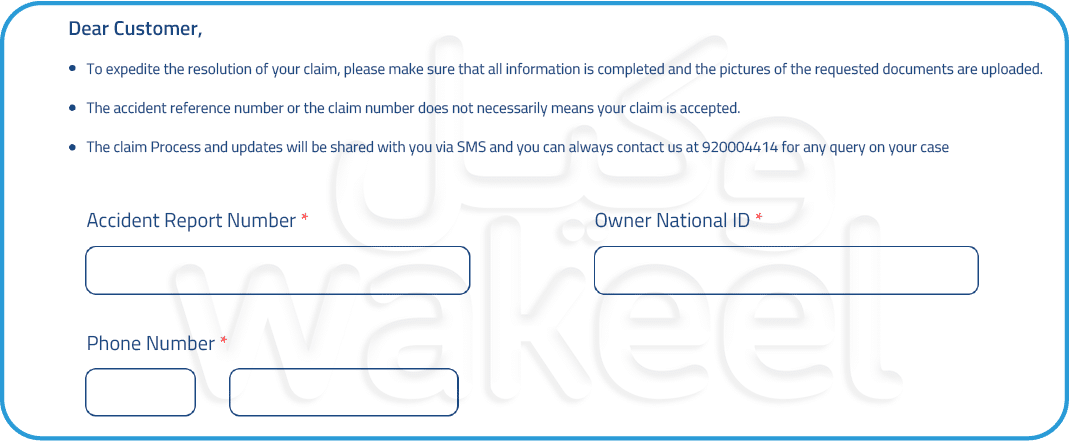

Insurance companies typically receive a Najm report within 48 hours of a car accident in Saudi. After that, you can easily file a claim with Al Rajhi online through their website or mobile app. Just look for their “Submit a Claim” section.

The screenshot below show you what to expect when you file a car insurance claim with Al Rajhi Takaful 👇

Once you’ve filled out the basic details, it’s time to attach the following accident documents:

Step 3: Get your claim number

After submitting your claim, you’ll receive a reference number right away. Within 2 business days, Al Rajhi Takaful will review it and contact you to:

- Confirm your claim is accepted and provide a claim number for further processing.

- Inform you of missing documents and provide a link to finish your paperwork.

If you don’t hear back within two days, call Al Rajhi Takaful’s hotline at 920004414 to track the status of your claim.

What happens next?

Once your claim is accepted, the Al Rajhi Takaful team will assess the damage and determine the extent of the loss.

- For partial damage: They’ll pay to repair your car and get it back to its pre-accident condition.

- If your car is totaled after the accident: Al Rajhi Takaful will pay you for the car’s price in the market, and their team will contact you to explain the handover procedures to the (Scrapyards).

Here’s an important reminder: Your compensation amount may be reduced based on deductible, depreciation rate (per policy), and your share of the accident fault.

How long does it take for Al Rajhi Takaful to pay insurance claim money?

Al Rajhi Takaful will aim to pay your claim payout 5 days after receiving all your documents, if the amount is 2,000 riyals or less. For claims exceeding 2,000 riyals, expect the payout within 15 days of completing the paperwork.

What if you’re having trouble with your Al Rajhi Takaful claim

- File a complaint through the website

Submit a complaint form on the Al Rajhi Takaful website. They’ll work to resolve your issue and update you within 10 business days.

- Escalate to the Insurance Authority

If it’s been more than 10 days and you haven’t heard back, or you’re unhappy with Al Rajhi Takaful’s response/ final decision, you have the right to escalate your complaint further. You can do this through the Insurance Authority website or by calling 0551124800 (between 8:00 AM and 4:00 PM).

For a stronger complaint, clearly explain the details and gather any documents that support your case. These documents act as evidence. Don’t forget to include your claim number and contact information too.