Saudi Insurance System: Who Does What?

You probably already have vehicle insurance because it’s mandatory in Saudi Arabia and health insurance for emergencies, But do you know anything else about the insurance system in Saudi Arabia? Getting yourself familiar with the system and who’s who will save you time and frustration when you need your insurance the most!

Let’s walk you through the key authorities and services, so you’ll know exactly who to reach out to and when.

Compare Car insurance quotes

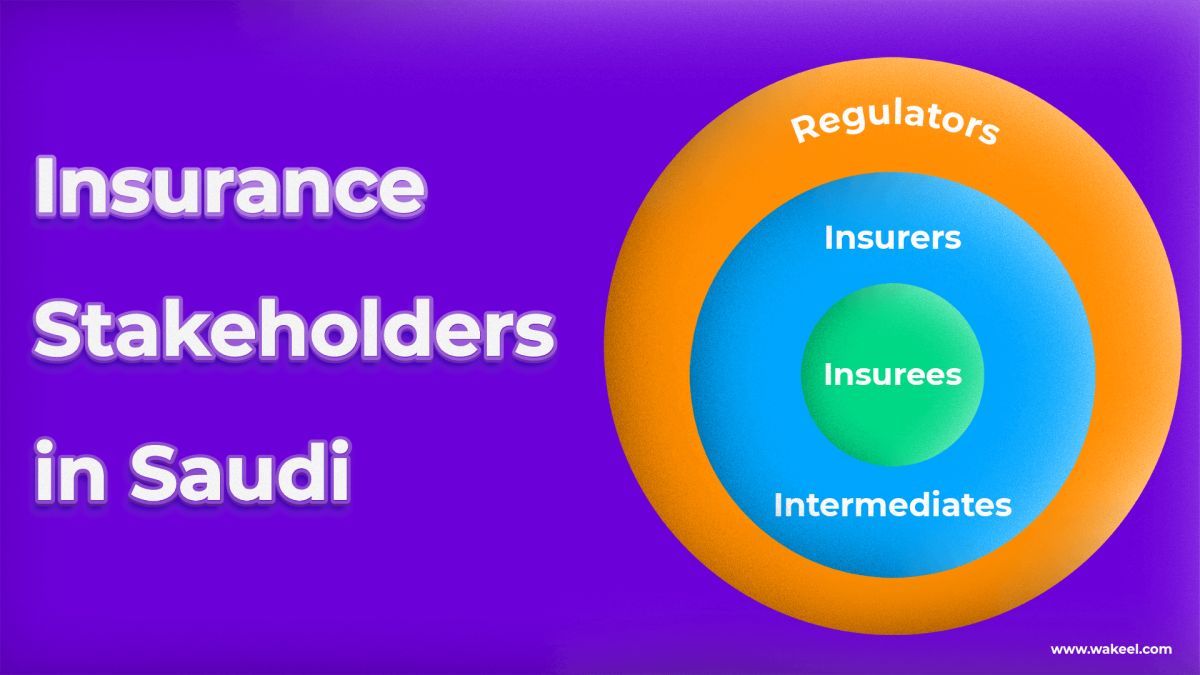

Who’s WHO in Saudi insurance?

Each organization has a distinct role in ensuring the system runs smoothly, from regulation to accident management.

Here’s a quick guide to who they are and what they do:

1. Saudi Insurance Authority

The Insurance Authority (IA) is the main government regulator for the entire insurance market in Saudi Arabia. This new authority replaced the Saudi Central Bank (SAMA) and now regulates all insurance activities.

The Insurance Authority in Saudi…

- supervise and license all insurance companies, brokers, and agents.

- set rules and standards for each type of insurance.

- handle consumer complaints. If you can’t resolve an issue directly with an insurance company, you can contact IA for help.

2. The Insurance Dispute Committees

The Insurance Dispute Committees (IDC) is a specialized court that reviews insurance cases in Saudi Arabia.

If you have a serious disagreement with an insurance company about a claim, policy interpretation, or any other issue that you can’t resolve directly, the IDC provides legal judgment.

3. Authorized insurance providers

Insurance providers are the licensed businesses that sell, and manage various types of insurance products – from car and health insurance to home and travel coverage.

| Entity | What They Do | When to Contact Them | Examples / Notes |

|---|---|---|---|

| 🏢 Insurance Companies | Licensed by the IA to issue policies, collect premiums, and pay claims. | When purchasing a policy or submitting a claim. | Examples: Takaful Al Rajhi, Malath Insurance, SAICO, MedGulf, and others. |

| 🧑💼 Insurance Brokers | Act as middlemen between clients and multiple insurance companies. They compare offers, explain coverage, and help you choose the best policy. | When you want to compare prices and coverage before buying insurance. | Today, many brokers are e-brokers — they have websites where you can compare prices and buy insurance online. |

| 🤝 Insurance Agents | Represent 1 specific insurance company and sell only their insurance products. | When you prefer a specific company and want to purchase directly from their authorized agent. | You can find a list of approved agents on the Insurance Authority’s website. |

4. Najm

Najm is a specialized company that works closely with Traffic Directorate and car insurance companies in Saudi Arabia. They manages a database of vehicles, drivers, and accidents. Najm provides these key services:

- Responding to traffic accidents and issuing the official accident report.

- Checking your insurance surplus.

- Inquiring about your no-claim discount eligibility.

- Filing claims online.

5. Moroor (The General Department of Traffic)

The General Directorate of Traffic (Moroor) steps in only for serious accidents or owhen none of the drivers have car insurance.

Taqdeer is the name of the offical vehicle damage assessment centers in Saudi Arabia. Their reports helps your insurance company determine how much compensation or repair coverage you’re entitled to.

7. Ministry of Commerce (MOC)

Ministry of Commerce handles consumer protection issues but they’re not usually involved with car insurance or car accident problems unless you’re unhappy with a car repair, spare parts, or poor service from a car dealership after an accident.

Know your rights, know your contacts

Saudi Arabia’s insurance system might seem complex, but once you know who’s responsible for what, it can save you time and stress!

All in all, the more familiar you are with how the insurance system in Saudi Arabia works, the more confident you’ll feel handling any issue — from a simple claim to a major dispute.