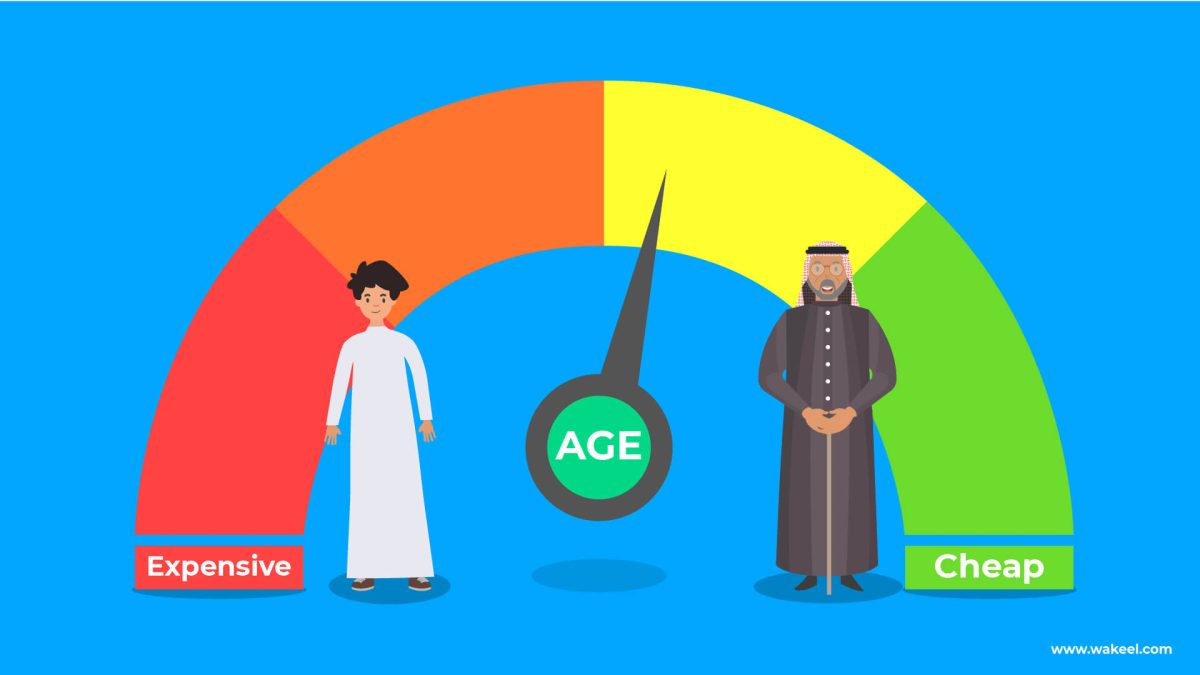

Age & How much does car insurance cost in KSA

Your age is more than just a number for car insurance companies in Saudi Arabia! To them, age shows your risk. Risk here means how likely you are to get into an accident that would cost them money. The more risk, the higher your insurance price — especially if you have comprehensive car insurance. Below, we explain why car insurance prices in Saudi are different for each age.

🔍 Key Takeaways

Age affects your car insurance price.

With a solid no-claim discount, prices usually start to drop after age 25.

Car insurance in Saudi is cheaper and better for experienced, middle-aged drivers.

For drivers under 25, it’s cheaper to drive someone else’s car and be an “additional driver” than buy car insurance on your own.

What affects the price of car insurance?

In Saudi Arabia, insurance companies set your price based on how “risky” they think you are. That includes things like:

- Your age

- The type of car you drive

- What kind of insurance you choose

- How many accidents you had

- Where you live (your national address)

👀 How much does car insurance cost in Saudi Arabia?

The easiest way to figure out how much car insurance costs is to get a quote! Use a comparison site & you can get quotes from all the insurance companies in Saudi Arabia at once!

Why does age matter so much?

Car insurance is expensive for anyone <25

Car insurance companies rely heavily on data — and that data shows that drivers under 25 (or just got their Saudi driving license) are more likely to get into accidents.

What you can do to get cheaper car insurance is to have the car registered under someone older (like a parent or sibling) with a clean insurance record, and list yourself as an additional driver.

📊 Things start getting better after 25

By the time someone turns 25, they usually have more responsibility and better judgment on the road. And by 25, you could be eligible for up to 60% off your car insurance costs with Najm discounts.

📈 Best car insurance prices come after 30

Drivers in their 30s (and even 40s and 50s) get the lowest car insurance prices in Saudi. That’s because their driving is seen as safe and responsible — and insurance companies love that.

That said, insurance prices may go up again as drivers get older, especially if age starts to impact vision or their focus.

Be smart, get the best deal

You can’t change your age (we wish, right?), but there are other things you can control — like how you drive and how you buy car insurance. Drive safely, and insurance companies will notice. And when you compare quotes before you buy, it’s impossible to miss the best car insurance deal when you see all your options.