How to Claim Car Theft on Insurance

What could be worse than fumbling in your empty pockets for your car keys, other than your car going missing entirely? Car theft is a real nightmare. In 2017, official figures from the Ministry of Interior reported an average of 38 cars stolen in Saudi every day. The report said most of the car thefts took place in the major cities; where the thieves usually change the car outlook and its plate number, before dismantling cars and selling their parts. While car theft is not as common as it once was, it is unfortunately still something you need to protect yourself against. So, here’s how what you can do to keep your car safe and avoid theft.

Car Insurance: Theft Cover

Car theft is an awful experience, leaving victims overwhelmed and disoriented. However, finding out your car insurance covers theft could ease your worries and help put this situation in the rear-view mirror. That is to say, you will be able to recoup your loss with the right insurance policy. Let’s be clear here, compulsory insurance (TPL) won’t cover theft of the vehicle. Whereas, a comprehensive car protects you against loss, damage, and theft-related problems, such as:

- Replace your stolen car

- Replace some car parts that are stolen or damaged – but not your personal item, unfortunately.

- Repair damage caused by theft or attempted break-in.

Steps to Report Car Theft in Saudi

It can feel like a real-life nightmare when you discover your car isn’t where you left it. But before you start panicking, rule out these possibilities:

- Have you loaned the car to a family member or a friend before?

- Have you parked your car somewhere else this time?

- Was it parked illegally and got towed away?

- If you’re behind on payments, was it repossessed?

If your car was indeed stolen, then here’s what you should do:

How to Report a Stolen Car

- Firstly, Report the theft to the police: Call 999 or visit the nearest police department. You’ll need to provide information about your car, such as its license plate number, registration (ISTIMARA), color, make, and model. Ask for a copy of the police report and the case number, which you’ll need in the next step.

- Secondly, contact your insurer: After filing a police report, you must inform your insurance company that your car is no longer in your possession to avoid legal liability. So, make sure to attach the police report along with the documents required to file a claim.

- Post your lost car online: posting about your stolen car on social media can put your community on notice. This could help recover your car faster. Especially, when you include a picture and the date and time you last saw the car.

What if someone steals something from your car?

Of course, you can still be a car theft victim without having your entire vehicle stolen. Most car thieves would rather steal the spare parts than the whole car since they know the risks. The perfect crime requires meticulous planning, which involves carefully choosing the time and place to go unnoticed. Taking into account all possible outcomes, thieves often target cars’ parts and contents and leave cars behind. Actually, stealing parts is easier to accomplish, and more profitable.

Why do car thieves go after parts?

- One, because they’re easier to steal. Usually, stealing car parts doesn’t require breaking windows or locks. With the right tools and a car jack, thieves can remove and steal car parts in just a matter of minutes.

- Second, they can go unnoticed. Stealing a whole car can’t go unnoticed; because of size, obviously, and its special VIN. Instead, thieves will often focus on removing specific car parts or accessories that are hard to track and easier to sell.

- And most importantly, profit. Selling car parts for scraps has always been a lucrative business. Thieves can put up the stolen items for sale on the black market and make money.

What items are most likely to be stolen from cars?

Number one, tires and wheels

It surely doesn’t come as a surprise to find tires and wheels on the top of the list! If you’ve bought new tires or wheels recently, you know expensive they are. Aftermarket tires are some of the most popular automotive accessories—and the more expensive the vehicle, the more expensive the wheels.

A brand-new tire can cost anywhere from SAR1200 to SAR 1300 per wheel, that’s around SAR 4800 for your entire car! Unfortunately, thieves have this same knowledge. With the proper tools, it doesn’t take long to remove your car’s tires and wheels set the car down on some bricks, and leave it in no condition to drive.

Don’t let this nightmare become your reality, park your car in a secured garage. Learn more about where should park your car.

Catalyst converter & batteries worth their weight in gold

During the last three years, an epidemic of catalytic converter theft became a major headache for hybrid car owners around the world. A catalytic converter is a piece fitted to car exhausts that turn the toxic gases and harmful pollutants expelled from the engine into cleaner material. This eco-friendly part is popular with thieves; because they’re easy to steal and the materials they’re made with – platinum, palladium, and rhodium – are currently more valuable than gold.

The catalytic converter theft boomed under the pandemic and is still flourishing. A survey illustrated that theft of catalytic converters in London had increased from just 154 to 12,482 thefts over a 3-year period. In total, from 2017 to 2020, London-based catalytic converter thefts totaled over 15,000.

Similarly, car batteries can be taken easily and they’re worth something at the scrap yard. In fact, car batteries can be as precious as industrial metals since they are 70% lead.

Personal Possessions

Never assume it’s okay to leave your car unlocked; just because you live in a safe neighborhood is safe. If anything, thieves are opportunistic and they know you’ll think that and act upon it!

Leaving your car unlocked with personal possession on display is nothing but an open invitation to thieves.

Don’t leave anything on display in your car. Even an empty wallet on the back seat is a temptation for someone to “smash and grab.” When a thief breaks into your car, your personal belongings won’t only be stolen but you will also have to deal with fixing a broken window or door lock.

In particular, thieves steal anything attractive first and think about its value later. Here are a few things you should never leave in your car:

- Cell phones, AirPods, GPS devices, laptops, and tablets (or any other easy-to-sell electronic device)

- Checkbooks, credit cards, and debit cards

- Cash (including loose change in your cupholder)

- Wallets and purses

- Car keys

Should I make an insurance claim if my possessions are stolen?

Reporting to the police should always be your first step. Then, depending on the type of insurance coverage you have, you may be eligible for compensation from the car insurance company. Overall, there are different types of insurance coverage.

Generally, third-party insurance only covers you against third-party damages and losses, Whereas, a comprehensive insurance policy will give you benefits of both own-damage cover and third-party liability cover.

Still, each comprehensive insurance policies offer a different kind of features and benefits. A standard comprehensive policy will typically reimburse the cash value of the stolen car. However, the insurer will not cover losing any personal belongings that were left in the car.

Whereas, other comprehensive policies will include some level of personal possessions cover to help you quickly replace that laptop or that phone. For that reason, you don’t want to skip comparing car insurance policies before you buy one.

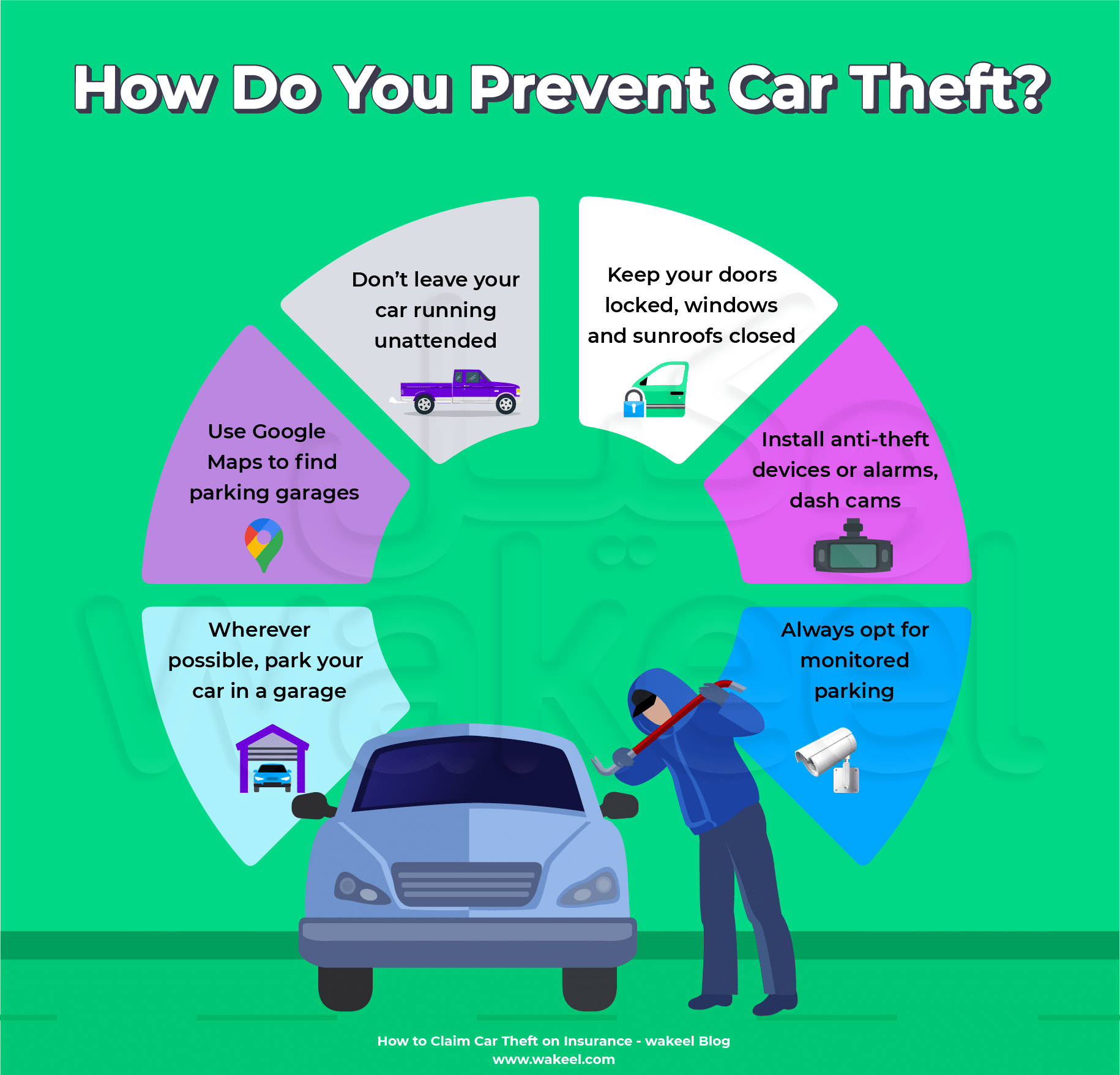

How Do You Prevent Car Theft?

Car thieves are getting increasingly savvy. In reality, car theft gangs are very organized and can steal your vehicle in seconds. They will choose an easy target, so make it hard for them! Here’s what you can do to prevent your car from being stolen and fend off thieves:

- Don’t leave your car running unattended. Every year, a significant number of vehicles are stolen when the car’s engine is on. In this case, you can’t claim compensation if your car is lost due to negligence.

- Keep your doors locked, windows and sunroofs closed anytime you aren’t in the car.

- Install anti-theft devices or alarms, even dash cams can deter car thieves if they know they can easily be identified.

- Don’t leave any valuable items in your car.

- Wherever possible, park your car in the garage.

- Otherwise, always opt for secure, well-lit, and monitored parking.

On a final note, sophisticated or even unsophisticated criminals will always find a way to crack code and steal cars. So, don’t get caught off guard by not having a backup plan to carry your day-to-day life. The easiest way to avoid such a headache is to be protected by comprehensive car insurance.

Struggling to find affordable insurance?

Overall, understanding the ins and outs of claiming car theft on insurance is crucial if your vehicle gets stolen. Quick action, like reporting to the authorities and your insurer while providing all the necessary paperwork, boosts your chances of a successful claim. But hey, prevention is a big deal too! Invest in anti-theft gadgets, pick well-lit parking spots, and stay watchful about your car’s safety.

Now, for those struggling to find pocket-friendly comprehensive car insurance, exploring different options is key. And guess what? Price comparison websites are your best friends here. They make it super easy to get multiple insurance quotes and compare car insurance prices online. Start comparing car insurance offers today to find coverage that not only shields your wheels but also fits your wallet.