The History of Car Insurance in Saudi Arabia

Although car insurance has recently become compulsory in Saudi Arabia. Arabs had a great understanding of insurance a long time ago. As a matter of fact, Arab merchants practiced insurance in the winter and summer trade. Discover more about the history of the insurance industry in Saudi Arabia and the evolution of insurance over the years.

What is Insurance?

Linguistically, insurance derives from assurance which means safe, secure, undoubted. In other words, insurance means to pledge to provide protection and security.

As for commercial sense, it is an agreement between two parties whereby the First Party (the insurer) undertakes to pay compensation for specified in return for payment of a specified premium from the Second Party (the insured).

How did insurance start?

The story of insurance is long and fascinating, and its roots trace back further than you might think! Even as far back as the time of Prophet Yusuf (AS), we see examples of planning and preparation to reduce risk, similar to the core idea of insurance. His foresight in managing the fertile and lean years could be considered an early form of “crop insurance.”

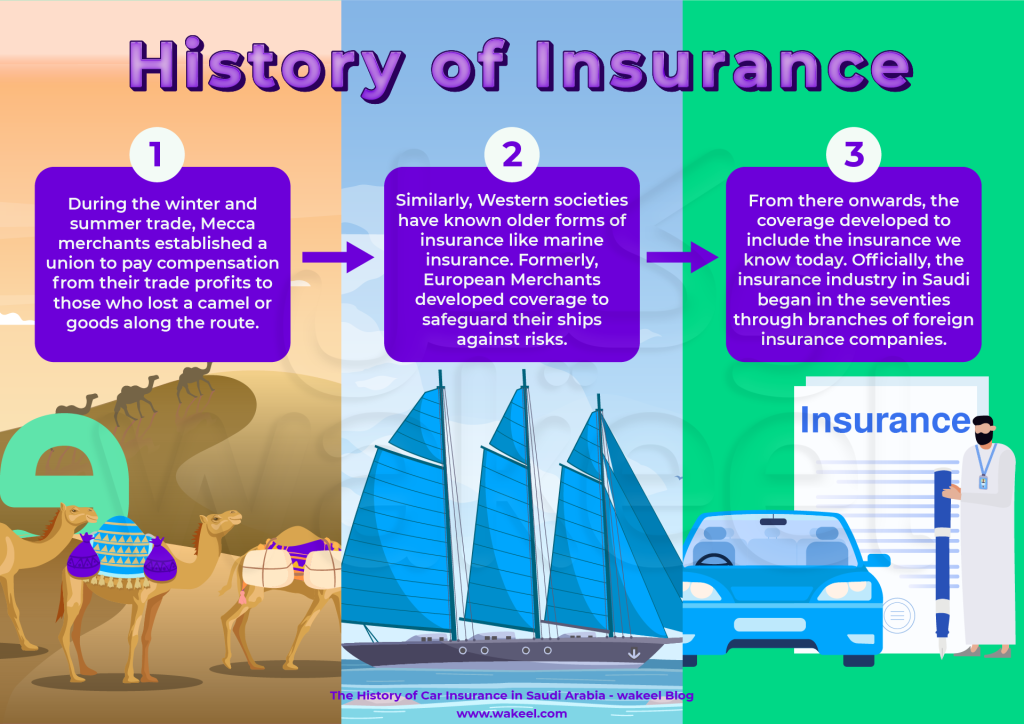

Further evidence of early insurance practices comes from the writings of Ibn Khaldun. He describes how Arabian merchants during the archaic period formed a union to share losses during seasonal trade journeys. If a merchant lost a camel or goods, they received compensation from the group’s pooled resources. This concept remarkably resembles modern cooperative insurance, with camels taking the place of today’s cars!

In the West, maritime insurance was one of the earliest forms of coverage, developed by European merchants to protect their ships during voyages. This eventually paved the way for the diverse insurance practices we see today.

Fast forward to the 1970s, and the official entrance of the insurance industry into Saudi Arabia through branches of foreign companies. Since then, it has blossomed into a crucial part of the Kingdom’s financial landscape, experiencing rapid growth as one of the fastest-developing industries.

From humble beginnings to modern day: a look at Saudi insurance history

Late 1960s:

- 1969: Social security takes center stage with the birth of the General Organization for Social Insurance, protecting Saudi citizens.

Early 1970s:

- Foreign companies arrive, setting up agencies and branches to kickstart the insurance industry.

- 1974: Red Sea Insurance Company makes a splash.

- 1975: Star Insurance joins the scene.

- 1976: United Saudi Insurance Company enters the game.

1980s and 1990s:

- International players enter the Saudi market, bringing global expertise and competetion.

- 1986: National Cooperative Insurance Company, later known as “Tawuniya”, paves the way for Saudi-owned companies.

- 1999: Cooperative Health Insurance Council is established.

2000s:

- 2002: Driving license insurance becomes mandatory becomes a thing.

- 2003: Cooperative insurance companies come under the watchful eye of the Saudi Central Bank (SAMA).

- 2006: License insurance exits, making way for 13 new cooperative insurance companies by 2008.

- 2008: Car insurance replaces license insurance.

2010s:

- 2016: Workplace health insurance becomes mandatory for employees and their dependents.

- 2017: Drive safe, pay less: Car insurance prices reflect your accident history.

- 2018: Compare and buy! Websites dedicated to car insurance price comparison emerge to help you find the best deals from licensed car insurance companies in Saudi.

2020s:

- 2023: A new era dawns! The Insurance Authority takes the reins, overseeing the industry.

- 2023: Don’t risk it! Electronic monitoring ensures everyone has car insurance.

- The Future: The Saudi insurance sector continues to grow and evolve, embracing innovation and technology to serve you better.

Car Insurance Boom in Saudi Arabia

Thanks to The Saudi Central Bank (SAMA) regulations and Vision 2030 insurance sector in Saudi witnessed rapid growth during the past years. In particular, these regulations and decisions helped many understand the importance of having car insurance; because it’s the only safeguard cars, reduce civil liability, among many other reasons to have vehicle insurance.

Primarily, SAMA was founded in 2003 to supervise licensed car insurance companies in Saudi. The bank is also responsible for regulating and developing the insurance sector, its aims to:

- Developing insurance products with transparency and efficiency

- Increasing competition between licensed insurance companies in terms of price – compare car insurance prices online in Saudi!

- Expanding outreach to the customer

In 2018, the Saudi Arabian Monetary Agency (SAMA) updated compulsory vehicle insurance to cover more drivers. In contrary to previous practice, now it covers licensed drivers aged 18 years and above.

On the other hand, Traffic Department made having valid car insurance a requirement for the vehicle’s registration renewal. Accordingly, many rushed to search for the best insurance offers and compare insurance rates in Saudi.

Car Insurance Digital Transformation in Saudi

Saudi Arabia’s ambitious vision of a digitally connected government is reshaping the insurance landscape. Platforms like Absher and Najm have become essential, making insurance more accessible and convenient than ever. From browsing options online to filing claims digitally, the ease and transparency are game-changers.

Comparison websites empower consumers to compare prices and features, ensuring they choose the best fit. This fosters healthy competition, ultimately benefiting everyone.

The future promises even deeper integration of technology. Artificial intelligence, machine learning, and blockchain can revolutionize risk assessment, claims management, and fraud detection. As Saudi Arabia embraces its digital future, the insurance industry will play a crucial role in securing the financial well-being of its citizens and residents.

bia.