What Should You Know About Surplus Distribution

There’s some good news for every car owner in Saudi Arabia: Your insurance company may actually owe you money! That’s right. You might be eligible for a cashback if you previously bought third-party car insurance or comprehensive. In insurance terms, this “cashback” is called surplus distribution.

Curious to know what Surplus Distribution means & how it can help you get a cheaper price on your third-party or comprehensive insurance renewal? Here’s everything you need to know…

What does Surplus mean in Insurance?

Put simply, Surplus means you have more money coming in than going out.

In insurance, Surplus refers to the amount of money an insurance company has left over after it pays all of its claims and covers its expenses.

So, where does all that extra money come from?

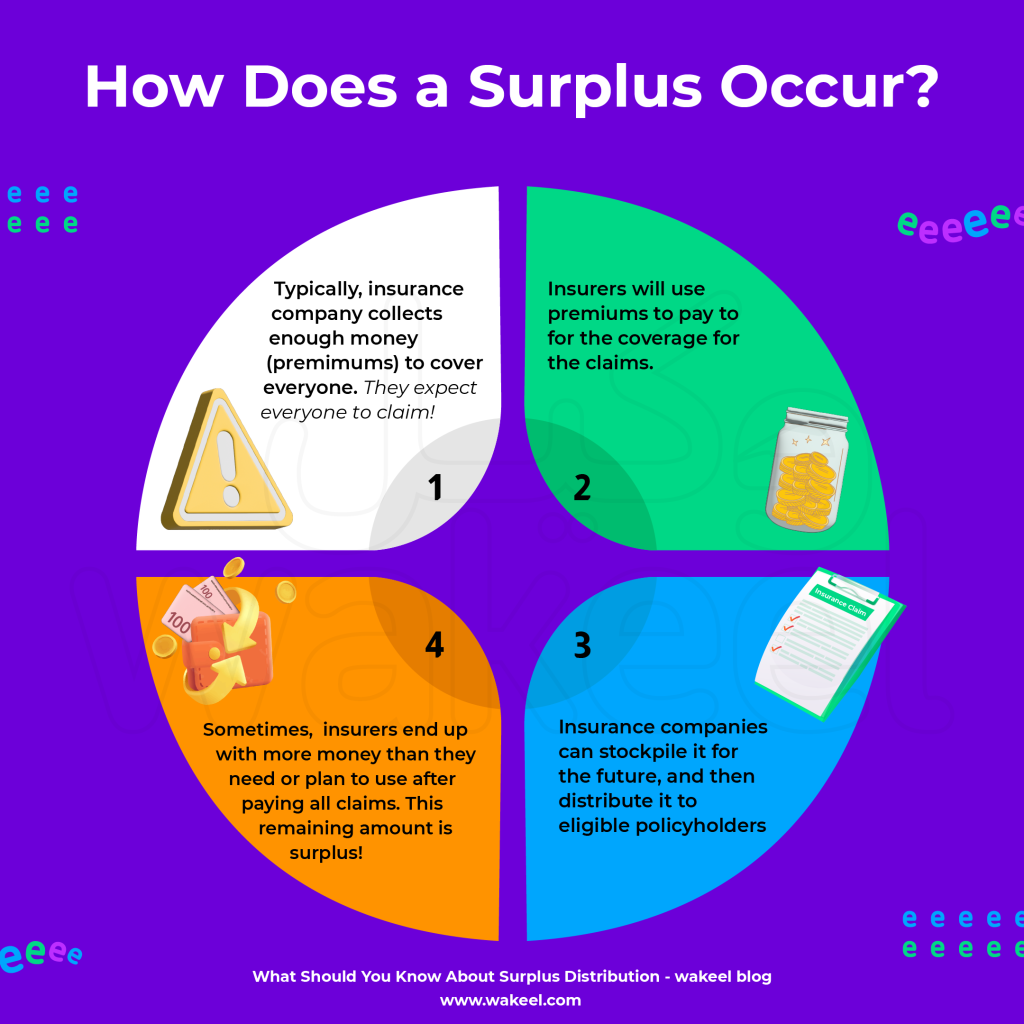

Basically, insurance companies generate a surplus when they collect more in premiums than they pay out in claims.

If they collect 10 million riyals, but only have to pay out 5 million in claims, they have 5 million riyals left over. That’s the surplus! So, it’s the extra money they have after taking care of all their expenses.

The Saudi Insurance Authority requires insurance companies to share at least 10% of their surplus with their customers. To get your share, you need to:

- Keep your insurance active. Don’t cancel it early! If you cancel your insurance to sell your car or transfer vehicle ownership, then you won’t be eligible.

- Avoid making too many claims. Your claims shouldn’t cost the company more than 70% of what you paid for your car insurance.

- Be debt-free: You can’t owe the insurance company any money.

Use Najm to check how much surplus you’re entitled to 💰

Just check the Najm app or website. You can check your surplus balance from previous years too.

Najm Surplus Service

So, you’re wondering when you get a piece of the pie, right?

Well, don’t get your hopes up too high. The amount you’ll receive is usually pretty small. It depends on how much profit the company makes, how many customers they have, and some other technical stuff.

But don’t let that discourage you – the money is still yours for the taking!

What can you do with the surplus?

- Direct deposit: You can simply ask them to credit the money directly into your bank account.

- Use it as a discount: You can hold onto it and use it as a discount when you renew your car insurance policy.

- Donate to charity: You can authorize the company to donate the money to a good cause on your behalf.

All in all, you won’t get rich from this. But keep in mind that companies that share their profits with customers often prioritize customer satisfaction. This suggests they may be more likely to offer competitive pricing, good customer service, and fair claim settlements.

So, the next time you compare car insurance prices on wakeel — give an advantage to the companies who have been able to distribute surplus in recent years.