Saudi Insurance Industry Components

Most people in Saudi have some kind of insurance: either TPL or Comprehensive insurance to cover their car, or health insurance to cover hospitalization costs, the cost of medicines, or consultation fees. Yet most of us don’t stop to think too much about the insurance industry or how it works.

As an industry, insurance is made up of numerous government and private bodies responsible for various tasks, roles, and jobs. Thus, there’s a lot to learn about who does what in the insurance industry. Although being aware of the ins and outs takes some effort, it’s vital to better manage your insurance-related needs. Besides, when you’re armed with this knowledge, you’ll be able to differentiate between insurance products and services provided by companies.

Read about the key actors involved in the Saudi insurance industry – regulators, service providers, and the insured– and the types of insurance available in Saudi Arabia.

Key role players in the Saudi insurance industry

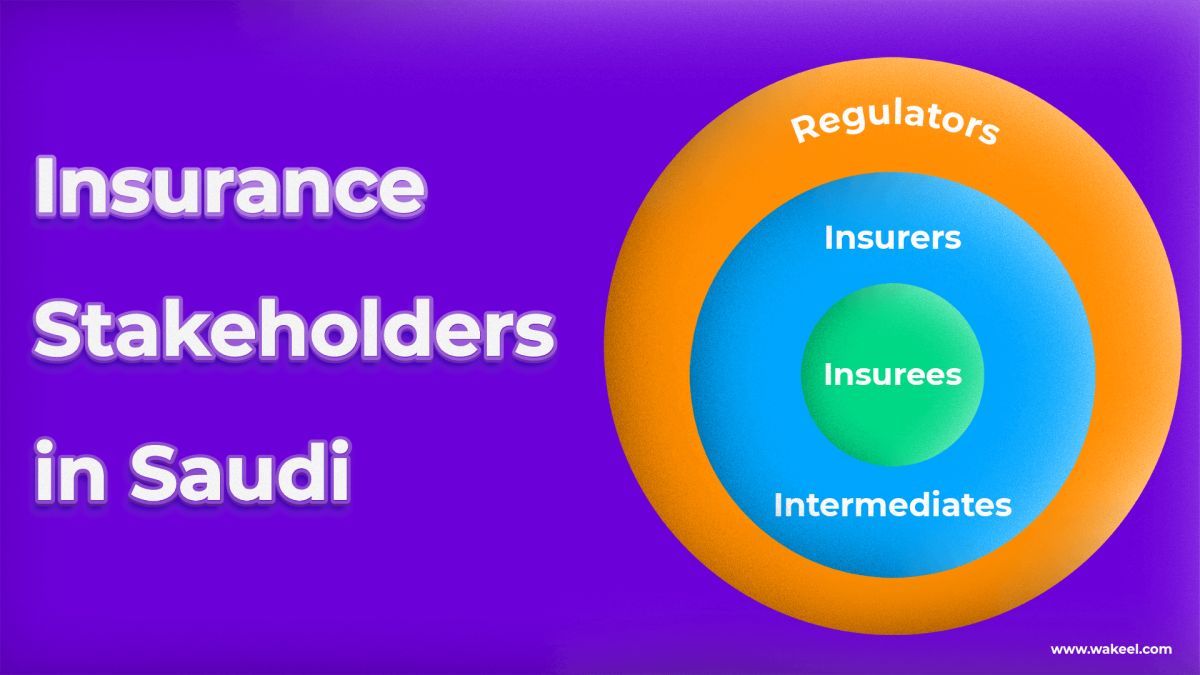

In general, the insurance industry in any market consists of 3 main participants:

- Regulators: licenses insurance companies to practice insurance activities in Saudi. In addition to supervising and regulating the insurance sector entirely.

- Insurers: are the entities that sell insurance policies to insurance consumers: individuals or companies.

- Insured: refer to the person or business that is covered by an insurance policy ie. the party who gets compensation in the event of a certain loss.

Insurance sector regulators

- Saudi Central Bank. The Central Bank of Saudi Arabia, also known as SAMA, is the regulatory authority for insurance companies operating in Saudi. It issues all rules, decisions, circulars, and regulations. Moreover, SAMA receives all insurance-related complaints.

- Cooperative Health Insurance Council. is a governmental body that focuses on the implementation of health insurance in Saudi Arabia.

- The General Secretariat of the Committees for Resolution of Insurance Disputes and Violations. is responsible for resolving disputes arising from insurance products. Put simply, they act as a mediator between you and the insurance company, enabling both parties to arrive at a fair solution.

Car insurance stakeholders

Car insurance is Saudi’s largest general insurance line after it became mandatory in 2018. To promote the car insurance sector and ensure its soundness SAMA and the General Department of Traffic had to establish new entities. These entities include:

- Najm. operates a range of services including accident review, damage assessment, processing claims, and other insurance-related services.

- Taqdeer. is responsible for detecting and assessing damages following car accidents.

- Manafeth. is the mandatory insurance system for non-Saudi vehicles entering or passing through Saudi Arabia via its border crossing.

Insurance providers

On the whole, insurance providers refer to a person or company that sells insurance policies; The insurer is the party in an insurance contract that promises to pay compensation.

- Insurance companies. A joint stock company that creates insurance products to take on risks in return for the payment of premiums.

- Insurance brokers. is a person who, independently, arranges between an insurance buyer on the one hand, and any insurance company; In return, they receive a commission from the insurance companies for their efforts.

- Similarly, e-brokers allow users to compare rates and buy insurance online. In fact, there are many companies that are registered to provide a comparison of prices for insurance policies online.

- Reinsurance companies. Surprise! Insurance companies have to buy insurance too. In short, re-insurance enables insurers to protect themselves and hedge their losses.

How many insurance companies are there in Saudi?

Currently, there are 27 licensed insurance companies in the Kingdom after the merger of “Al-Jazira Takaful Cooperative” and “Solidarity Saudi Takaful” companies. Before that Walaa Cooperative Insurance Company merged with MetLife, American International Group, and Arab National Bank for Cooperative Insurance in 2020; In addition to the previous merger of the Gulf Union Cooperative Insurance Company with the former Al-Ahlia Cooperative Insurance Company.

Refer to the Saudi Central Bank’s list of licensed insurance companies and related businesses in Saudi.

Insured

By contrast, an insured is a person or organization whose life, health, or property is covered by an insurance policy.

- ِIndividuals. For instance, the insured could refer to the person who buys the policy from the insurer, such as a comprehensive car insurance policyholder. Alternatively, the beneficiary of the policy can also be someone other than the policyholder eg. a third party in TPL policies.

- Companies or SMEs. Organizations too buy insurance to protect their business against everyday risks, such as mistakes, stock or premises damage, and legal costs. Another example we mentioned earlier, is when insurance companies re-insure their policies.

Types of insurance products

The following types of insurance are available in Saudi Arabia:

- Car insurance, including comprehensive and third-party insurance

- Health insurance

- Travel Insurance

- Home Insurance

- Personal accidents insurance

- Medical malpractice insurance

- Protection & Savings insurance

How can you buy insurance in Saudi?

Before making any purchase, comparing pricing is a must — unless, you don’t mind overpaying for everything! The same goes for insurance, comparing pricing and coverage options could save you a tremendous amount of money. In general, insurance experts advise getting quotes from at least 3 companies. If you like the price and coverage selections offered by a company, you can move forward to buy your insurance policy.

Now, to get an insurance quote here are several ways. First of all, you can ask for personalized directly from an insurance company. Two, you can use a licensed insurance broker to compare your options. Three, do everything yourself online — Digitalization has become the norm in the Saudi insurance industry! In fact, using a price comparison platform to buy your insurance online is more convenient; because it offers a wider selection and the opportunity to compare products and prices easily across different insurance providers.