Things to remember when modifying your car

Modifying and making changes to your car is all about expressing yourself, but remember, safety always comes first! While it sounds like a fun idea, there’s a crucial aspect you might be missing: how these changes and mods may affect your safety & car insurance rates in Saudi.

We’re here to navigate the rules, discuss the consequences, and offer tips to ensure your dream car doesn’t turn into an insurance company nightmare!

What car modifications are allowed in Saudi?

Modifying your car in Saudi Arabia is possible, but with strict regulations. Let’s break down what’s allowed and what’s not:

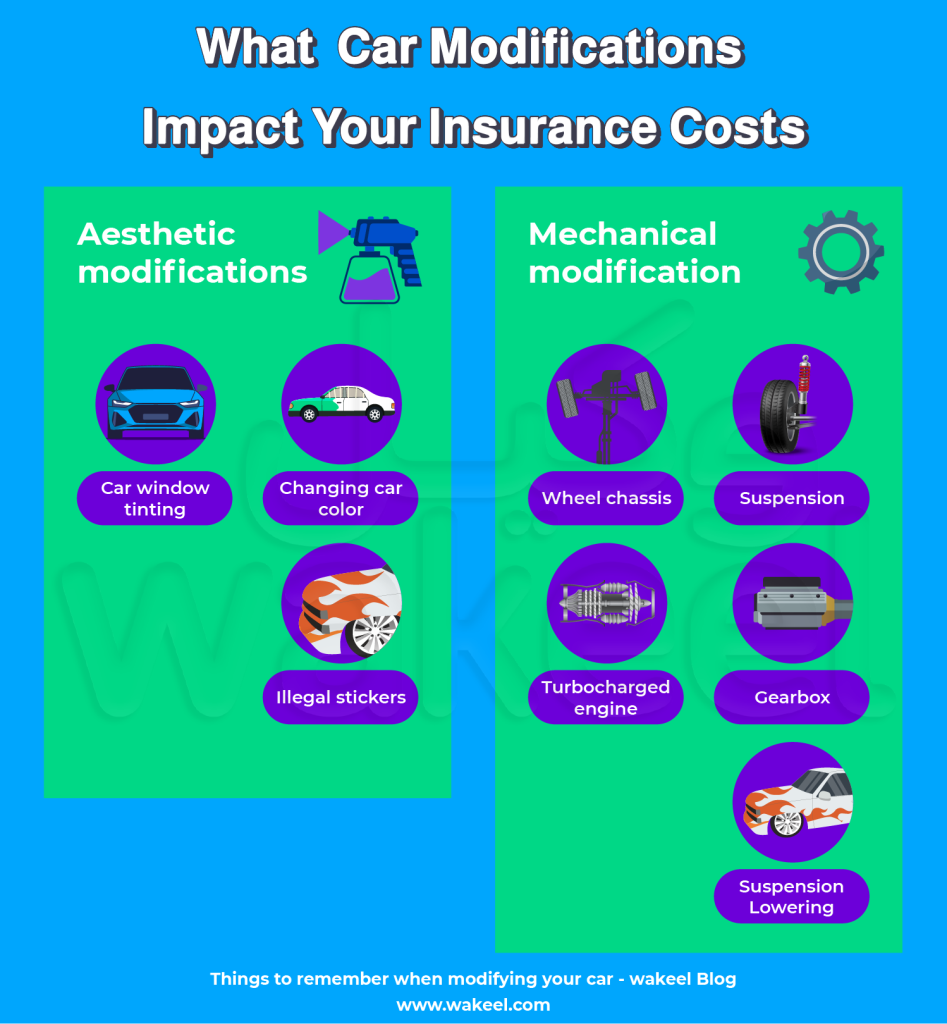

- Performance: Anything that boosts the engine’s power, like turbochargers, performance chips, or nitrous oxide kits, will usually lead to higher premiums. This is because they increase the risk of accidents and also theft.

- Suspension: Lowering the suspension or swapping out wheels for larger ones can affect handling and safety, potentially raising how much you pay for your car insurance.

- Aesthetics: You can modify most cosmetic aspects like wheels, rims, lights, or stickers as long as they meet safety standards and don’t obstruct visibility or functionality. Paint jobs usually require Muroor approval.

- Sound System: Modifications are okay within noise level limits (usually 90 decibels). Loud exhausts are a big no-no.

- Interior: Upholstery changes, adding screens, or other car accessories are generally fine, but ensure safety features and airbags remain intact.

Car changes will impact your insurance

- Be ready to pay more for your car insurance! Insurance companies like things predictable. So, when you modify your car, especially its performance (engine tweaks, suspension changes, etc.), this raises the red flag for your car insurance company. Of course, anything that would increase the risk of accidents will also lead to increased insurance rates.

- What’s worse than an accident? A rejected insurance claim. Imagine needing to file an insurance claim after an accident, only to have it rejected because you forgot to mention you made changes to your car. Yes! That could happen. Car insurance companies in Saudi have the right to reject claims if they discover undisclosed modifications. Never keep change a secret! Not disclosing “updates” with your car insurance company can leave you financially responsible in case of an accident.

Remember, even if you’re building your dream car from scratch, it still needs to comply with SASO’s safety regulations! So be sure to review Technical Regulation for Modified Vehicles and Limited Production Models before you order your car!

Not all mods are bad

Generally speaking, adding some personality with a new paint job, stylish rims, or cool LED lights or in-car entertainment system won’t affect your insurance. As long as your planned changes don’t affect your car’s performance or safety, you’re good to go!

Additionally, dashcams, parking sensors, and alarms can even make your car safer. Think about it: changes that make accidents more likely increase risk. The result? Higher car insurance rates for you.

Steps to modify your car legally in Saudi

- Check Muroor regulations. Before giving your car a makeover, make sure your planned modifications comply with the Saudi Traffic Department (Muroor) regulations. Their website or local office can provide details. odifications deemed road hazards or violating traffic laws can land you fines between 300 and 500 SAR, and even an impounded car!

- Use certified mechanics services. If you are modifying your car, it is important to do so with an authorized workshop. Certified mechanics know your car is made inside-out and use approved, tested parts. Not only does this ensure quality, but it won’t void your car warranty.

- Update your car insurance company. Be upfront! Before customizing, discuss your plans with your insurance company just to be safe. Once you modify the car, you’ll need to contact them to update your policy details too. They might need to adjust your coverage without increasing your premium, but failing to do so could mean rejecting claims later.

Are you struggling to find affordable insurance for your modified car?

Facing challenges in finding budget-friendly insurance for your modified car? Rest assured, you’re not alone! Numerous enthusiasts of sports, classic, and modified cars encounter similar hurdles when seeking affordable car insurance. Hence, our recommendation is to explore specialized insurance websites for comparing car insurance prices online in Saudi Arabia. These comparison websites make it easier to find affordable car insurance deals and compare each policy coverage. This way, you can get an insurance policy tailored to precisely meet your requirements.